November is Financial Literacy month in Canada – with the intent to get us all talking about money, getting comfortable with having unjudgmental conversations about finances.

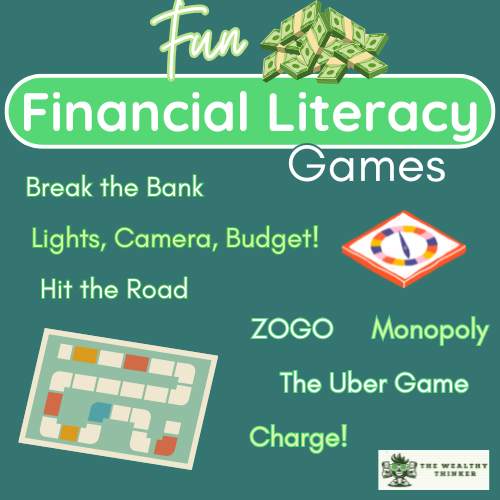

What better time to talk about financial literacy games?

There are basics of finance (literacy) that can help you understand more complex topics, but critical knowledge about managing your money can also be acquired in more fun ways too.

We’ve picked out 10 games that will keep you engaged and teach you the basics of finance that you need to know. Anyone at any age can learn financial literacy, from adults to kids.

3 Financial Literacy Games for Kids

When you’re teaching financial literacy to children, you focus more on the math principles of money.

Kids need to learn how to count money and how much something costs. Essentially, this is teaching money with addition and subtraction. Here are three math-based financial literacy games that are great for children.

Break the Bank – Sorting

Break the Bank is a great game to teach your child how to sort money.

This game seems simple, but for a young pre-schooler, it will teach them about dollars and coins. In addition, introducing this topic at a young age teaches a child how to ask questions about money.

6 Awesome Opportunities to Teach Your Children About Money

Lights, Camera, Budget!

After your child has mastered the true basics of finance, teach them about budgeting.

Lights, Camera, Budget! is a great game to teach your child how to budget. They are given a set amount of money and have to allocate their spending to help them make a Hollywood movie. This teaches your child how to budget and make smart financial choices.

Hit the Road

The National Credit Union Administration has created a game called Hit the Road.

This game is inspired by the classic Oregon Trail game. The game is to take a road trip and learn important financial literacy skills like:

- Budgeting

- Spending

- Debt management

3 Financial Literacy Games for Adults

A common complaint of many adults is they haven’t had the opportunity to learn financial literacy.

It’s not taught in schools, and when you become an adult, you’re essentially learning as you go. Adults can gain an immense amount of financial literacy from playing games, making them more interactive.

Anyone can play these three games to increase their financial knowledge.

Smart About Money

The National Endowment for Financial Education (NEFE) has created 13 courses to teach adults about money.

Adult learners can expect to learn about the following:

- Spending

- Saving

- Investing

There are quizzes to help facilitate learning to ensure you are actually learning about finances.

Invest in You: Money 101

Another great resource for adults to improve their financial literacy is the 8-week course from CNBC.

This course is great because you can get the lesson delivered to your email. In addition, they are bite-sized lessons that teach you about managing your money, especially during times of crisis. (Our editor just signed up for this!)

Charge!

One area that adults usually struggle with is credit.

It’s easy to have credit debt, which negatively impacts your credit score. The game Charge! helps adults learn the real consequences of credit in a safe environment. You can see how interest rates, payment amounts, and payment periods can impact your credit score.

3 Financial Literacy Games for Teens

Teenagers are in a good spot to beef up their financial literacy skills before they get their first part-time job or go to college.

The challenging thing is showing teens why learning about more advanced financial topics is important. Then, you have to bring the game to their level with things that interest them, especially if they can learn from a hot financial trend.

Here are three personal financial literacy games that will excite your teen.

The Uber Game

The Uber Game will teach your teen all about the gig economy.

The premise of the game is to see if you can make it there. Gig work is popular, and many teenagers are seeing side work as how they will earn an income over a traditional job. Your teen will see if they can truly make a living as an Uber Driver! (It’s pretty fun – I just tried it.)

Financial Football

You may be surprised to learn that Visa and the NFL created a financial literacy game.

Financial Football is an interactive, 3D game that is perfect if your teen loves football. There are three different levels:

- Rookie

- Pro

- Hall of Fame

Each level will add to previous levels. Your teen will learn about budgeting, spending, and saving in a fun way that they understand.

ZOGO

One thing that motivates teens more than anything is money.

Your teen can learn about financial literacy and make money at the same time with ZOGO. This app is a great game to play to learn about finances, because as you learn financial literacy, you will earn gift card rewards. These gift cards can range from $5 to $15 from brands like Starbucks and Sephora.

2 Financial Literacy Games for the Whole Family

One of the best ways to learn about finances is to learn with others. Playing a family-friendly financial literacy game is a great way to:

- Teach financial literacy to your kids

- Start talking about money openly

- Allow your kids to ask financial questions

Here are two great finance games you can play with your family.

Financial Peace Jr.

Dave Ramsey is a household name to many families.

He teaches adults how to become debt free, and now he has a game to teach children about money. Financial Peace Jr. is a kit that helps your child learn about the basics of finance:

- Working (Earning)

- Spending

- Saving

- Giving

The kit comes with a parent guide to help you teach these concepts to your children.

In addition, there is an activity book for your child, a chore chart, cash envelopes, and more. This first kit makes learning about these topics easier as they work with a book and complete activities along the way.

Dave Ramsey’s Baby Steps: 7 Simple Steps to Set Up Your Financial Health

Monopoly

Many families play Monopoly for fun, but it’s a great way to learn about money and start that conversation.

Monopoly teaches you about risks and how to measure those risks. For example, do you decide to spend your money to buy up properties quickly, or do you save your money and buy later in the game?

If you are the banker, you are doing additional work with finances, from handing out money to making change. Monopoly is a more traditional game with a lot of financial literacy components to it.

Final Thoughts

Games don’t just have to be for fun – you can learn and play a game!

Learning about finances through a book is possible, but it might not stick as well compared to playing a game to learn about finances. Financial literacy is important to securing financial security and generational wealth and can start as early as pre-school and as late as adulthood.

Editor’s note: This article was originally published May 22, 2023 and has been updated to improve reader experience.