When it comes to teaching kids about money, the super rich are different from average Americans.

This is because their perception about this widely regarded taboo subject is quite different from the average person. This is why they are rich, isn’t it?

The average family unconsciously passes down the same limiting beliefs they were taught about money from generation to generation e.g. money is evil, or to be wealthy you have to dip your hands into dirt.

These are the beliefs that have kept families at the same level of financial success for dozens, if not hundreds, of years.

Rich people, on the other hand, not only teach their kids smart money habits, but they teach them that it’s OK to want to be rich, and that wealth is possible for anyone who thinks big enough.

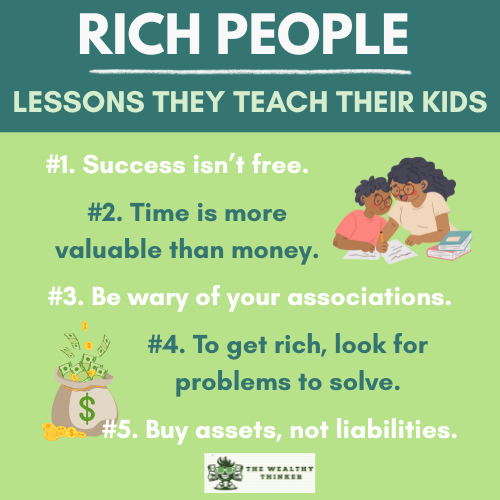

The sooner you can get your kids thinking like the wealthy do, the better off they’ll be. Here is a run-down of some lessons self-made wealthy people instill in their kids.

Generational Money Mindset: How Family History Shapes Your Financial Future

11 Lessons Wealthy People Teach Their Kids About Money

#1. Success isn’t free.

There is a lot of entitlement mentality being peddled to us.

People expect the government to take care of them, or corporations to raise living wages so that they can live more comfortably. Those who are the extreme of this spectrum, blame their parents for their financial conditions.

However, the world owes you nothing, and the sooner you adopt this mindset, the sooner you’re on your way to building wealth. Understand that long-lasting success comes through hard work and dedication. This entails sacrificing your time, sleep and leisure to build something great.

#2. Time is more valuable than money.

Rich people make their life decisions in terms of time rather than money.

The masses spend their time, while the rich invest in it. Time is the universal currency of life. With time on your side you can achieve a lot of things. You can regain money lost, but never time.

This is why you have to be judicious with your time and what you spend it on.

“Spend your time basking in entertainment, and you will struggle your entire life financially. Invest your time creating solutions to people’s problems, and you’ll never lose a minute’s sleep worrying about how to pay the mortgage.” – Steve Siebold, author of, ‘Secrets Self Made Millionaires Teach Their Kids’

6 Awesome Opportunities to Teach Your Kids About Money

#3. Be wary of your associations.

This is not a call-to-arms to be snobbish, or to look down on people outside your circle.

Rather it is a conscious and deliberate attempt to associate with people who are where you intend to be, or going in the same direction as you.

It is said that if you have nine millionaires as friends, you would be the tenth. As iron sharpens iron, mind sharpens minds. Your brain shapes itself around the people you surround yourself with.

If the people around you are motivated to succeed, the chances are high that being with them, your mindset will work in the same way. So, surround yourself with successful people – who you hang out with matters.

#4. To get rich, look for problems to solve.

Money is simply a paper representation of a value.

If you are wealthy, that means you have been able to accumulate value over time. This value, unless inherited, was transferred to you by other people in exchange for a product or service that meets their needs. So, the only way this value can be transferred to you is if you provide something that people need.

The top earners know that money flows from ideas and problem solving. The bigger the problem solved, the bigger the paycheck.

Come to think of it, the reason you’re earning a paycheck is because you’re solving a problem for your employer. Your skill sets are needed by your employer to fill a particular role for the company which enables them to make more profit. Why not amplify this on a bigger scale and live off your fortune?

#5. Buy assets, not liabilities.

The rich accumulate assets, not liabilities.

Even those who acquire luxury properties or vintage cars know that they can be sold off at a fair value when due. On the other hand, the average person spends most of their income on liabilities with little left over for assets.

Some may say such comments are unfair to low-income earners because they have little to get by, let alone setting aside funds to acquire assets.

However, the general misconception of this line of thought is how assets are defined. Simply put, an asset is something that increases in value over time or generates cash flow, while a liability is something whose value decreases over time or takes money from you.

As such, an asset does not have to be a property or real estate. It could be something as simple as an education or learning a skill. Anything that adds value to your life in the long term is an asset and should be sought by all means.

This is why most rich people are avid readers. They know that knowledge from books is an asset which can make them better investors and money managers.

#6. Make money work for you.

There are two kinds of people:

- those who work for money

- those whose money works for them

Unfortunately, the majority of humanity is in the first category. Working a 9 to 5, living paycheck to paycheck. So they sacrifice other important resources such as their time and labor for money.

The rich on the other hand, have figured out how to make their money work for them. This is through investments or owning assets that generate cash flow. This frees up time for them to engage in other things, thus increasing their earning power exponentially.

You do not have to be ultra rich, or have huge capital to make your money work for you. It could be owning a product that can generate income for you over a lifetime. For example, an author or musician can keep earning royalties off their works until they die from one single artistic project.

#7. Delay gratification.

The rich are investors, not spenders.

They invest their money today, so they’ll have more tomorrow. This can only be done once you have recognized the importance of delaying gratification. This entails sacrificing the pleasures of today for tomorrow’s gains.

For example, deciding to invest in your retirement or a house rather than taking that vacation or buying a new car. Since the rich understand that time is more valuable than money, they try to buy time by delaying their gratification and making small sacrifices today.

It is also applicable to long term investing which is regarded by most as boring. Short-term trading gives an adrenalin rush which makes it exciting and thrilling to traders.

However, you are also susceptible to market moves and emotions that could lead to losses along the line. Long term investors zoom out and keep their focus on their long term goals, not the gratification that comes from having something right now.

#8. Spend smart.

You won’t stay wealthy no matter how large your income is unless you have the discipline to keep what you earn. Excessive spending damages lives, and it occurs all the time to individuals with millions of wealth.

That isn’t to imply you shouldn’t spend money. The trick is to avoid overextending yourself in the process, since this will place you on a never-ending cycle of having and not having money.

#9. Money and opportunity are limitless.

This is a case of seeing the glass half full or half empty.

Poor and average people believe that money and opportunities are limited. Rich people on the contrary believe otherwise. They believe that money is abundant. This is not surprising coming from people who believe that to get rich, you have to solve problems.

And guess what? The number of problems is infinite, which implies that your ability to earn money is infinite too.

#10. Rich people are not always smarter.

A general misconception most people have is that rich people are always smarter.

The truth is, most of them are no brighter than the average person struggling to make ends meet. Getting rich is less about intellect and more about focusing on the accumulation of wealth.

They are just people who chose to act on the principles of wealth creation and not pander to the wealth-limiting mannerisms of the average person.

#11. Believe you can achieve – and you will.

The wealthiest people set high expectations for themselves and believe that they can achieve them.

No goal is insurmountable for them. The thing about thinking big is that even if you don’t achieve your goal, you would still be higher up than someone that set a lower goal.

What Lessons Rich People Teach Their Kids About Money

While the average person is content with playing it safe, seeking comfort, and avoiding pain, the rich on the other hand are doing the exact opposite. They are taking life by the scruff of the neck and demanding their place.

Thinking the same way as others produces the same results. As such, if you want to be rich, you have to start towing a different line of thought. Seek association with successful people and see if you can glean aspects of their life that can improve yours.

Extraordinary results come from extraordinary thinking. So why not change your views about money to have different results from the average Joe?

Editor’s note: This article was originally published Mar 9, 2024 and has been updated to improve reader experience.