Let’s be real – our wants are endless, but our money? Not so much.

Whether it’s dining out, upgrading tech, or planning that dream vacation, we all have things we’d love to do or buy.

The problem? We’ve got limited resources and a long list of priorities.

That’s where budgeting comes in. It’s not just about cutting back – it’s about taking control, getting clear on what matters most, and making your money work for you, not the other way around.

So, What is a Budget?

At its core, a budget is simply a plan for your money. It helps you map out what’s coming in (your income) and what’s going out (your expenses) over a set period—usually monthly or yearly.

But a budget is more than just numbers on a spreadsheet. It gives you a way to:

- Stay prepared for unexpected expenses

- Seize opportunities when they arise

- Prioritize what’s truly important to you

- Build a life that aligns with your goals

And yes – budgeting is the first step toward financial independence. If you want to save more, invest smarter, or finally stop living paycheck to paycheck, it all starts right here.

Why People Avoid Budgeting (And Why You Shouldn’t)

Let’s be honest – most people avoid budgeting because it feels uncomfortable.

It forces you to look at your spending habits and ask the tough questions.

But here’s the twist: once you face the truth, you gain clarity and power.

Creating a budget doesn’t have to be overwhelming or restrictive. In fact, it can be simple, freeing, and even fun when you find a method that works for you.

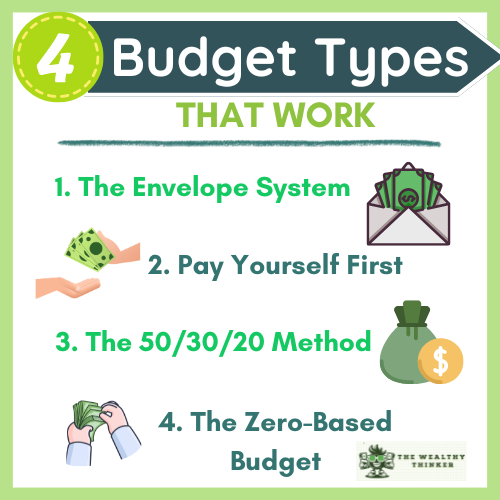

4 Budgeting Methods to Help You Save More & Stress Less

🏷 1. The Envelope System

Want to curb impulse spending without tracking every single transaction? This method’s for you.

How it works:

- Create envelopes for each spending category (groceries, bills, entertainment, etc.)

- Put a set amount of money in each envelope at the start of the month

- Spend only from the envelope—and when it’s empty, that’s it

This method is all about discipline and boundaries, helping you stay on track without needing complicated apps or spreadsheets.

Why it works:

It keeps your spending in check and forces you to live within your means. You literally see how much you have left for each category – no guesswork.

💸 2. Pay Yourself First

This approach flips the usual mindset on its head. Instead of saving what’s left after spending… you save first.

How it works:

- As soon as you get paid, immediately set aside a portion for savings or investing

- Use the rest for your monthly expenses

Why it works:

It builds the habit of prioritizing your future self – and prevents you from spending your entire paycheck before thinking about savings.

Pro tip: Automate your savings so it happens without you even having to think about it.

📊 3. The 50/30/20 Method

This method is ideal if you want a balanced approach to money management.

How it breaks down:

- 50% of your income goes to needs (housing, food, bills)

- 30% to wants (entertainment, dining out, hobbies)

- 20% to savings and/or debt repayment

Why it works:

It ensures all the bases are covered – your essentials are handled, you still have fun, and you’re building a financial safety net at the same time.

What’s the 50/30/20 Budget Ratio? A Simple Way to Set Your Budget

🧾 4. The Zero-Based Budget

Ready to get super intentional with your money? This one’s for the detail lovers.

How it works:

- Assign every single dollar of your income a purpose – until there’s “zero” left unaccounted for

- That doesn’t mean spending it all, it means every dollar has a job (saving, bills, debt, etc.)

Why it works:

This method is perfect for people who want structure. It gives you full visibility over your money and leaves no room for wasteful spending.

Zero Based Budgeting: How it Works & Possible Advantages

Final Thoughts: Budgeting = Freedom

Creating a budget isn’t about restriction—it’s about freedom. It’s your chance to take control of your finances, ditch the guesswork, and start building the life you actually want.

Yes, it might feel awkward at first. Yes, it might force you to look at spending habits you’d rather ignore. But on the other side of that discomfort is clarity, control, and peace of mind.

So whether you’re just starting out or looking to improve your current system, try one of these budgeting methods and take that first step. Your future self will thank you.

✅ Ready to take action?

Pick one budgeting method from this list and try it for 30 days. Track your progress, adjust if needed, and see how much easier it becomes to save, spend, and plan with confidence.

Editor’s note: This article was originally published Aug 30, 2021 and has been updated to improve reader experience.