If you’ve owned your home for a while, you’ve probably run the refinance math before and maybe decided it wasn’t worth the hassle.

Higher rates, high fees, or the feeling that restarting a 30-year mortgage clock just didn’t sit right.

In 2026, refinancing is back on the table – for some homeowners.

Rates are meaningfully lower than they were a few years ago, lenders are competing again, and a lot of people are looking at long mortgages and wondering if there’s a smarter way to finish this thing.

That said, refinancing isn’t automatically a good move. It’s a numbers decision with a few common traps. Here are the factors that actually matter and how they can save – or cost you – real money.

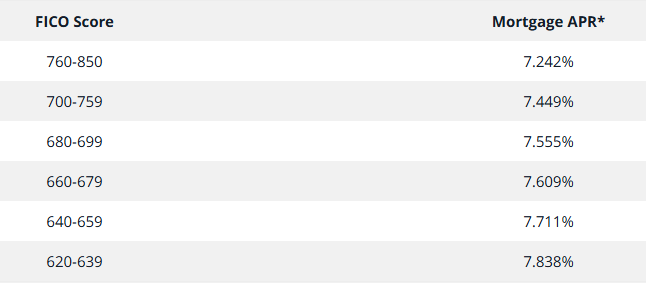

Factor #1: Your Credit Score (This Sets the Floor)

Your credit score determines the interest rate you’re offered. Even small differences matter over time.

Let’s keep it simple. Two homeowners refinance the same remaining loan balance:

- Higher credit score: Qualifies for a lower rate

- Lower credit score: Pays a higher rate

The difference might only look like a fraction of a percent, but over 10–15 years, that can mean tens of thousands of dollars in interest.

If your score is solid, refinancing in 2026 could unlock real savings. If it’s borderline, the math gets tighter, and sometimes it stops working altogether.

This doesn’t mean refinancing is off the table with a lower score. It just means expectations matter, and the savings may be smaller than the headline rate suggests.

Factor #2: Your Remaining Mortgage Term (This Is Where People Get Burned)

This is the most common refinancing mistake: resetting the clock.

Let’s say Joe has 17 years left on his current mortgage.

Option A: Refinance into a new 30-year loan

- His monthly payment drops, which feels great.

- But he adds 13 extra years of payments and pays more interest overall.

Option B: Refinance into a 15-year loan

- His monthly payment goes up.

- But he cuts years off the loan and saves a meaningful amount in total interest.

If your goal is long-term savings, restarting a 30-year mortgage is usually the wrong direction. Refinancing tends to work best when you shorten, or at least preserve, your remaining payoff timeline.

Lower payments aren’t free. They usually show up later as a higher total cost.

Factor #3: The Interest Rate vs. Your Break-Even Point

Refinancing comes with fees, which means you don’t save money on day one.

Your break-even point is how long it takes for your monthly savings to cover those upfront costs.

Example:

- Refinance costs: $4,000

- Monthly savings: $200

- Break-even point: 20 months

If you sell or move before that point, refinancing likely costs you money. This is where a lot of “good on paper” refinances fall apart in real life.

Be honest about your plans. If there’s a decent chance you won’t stay put, the math needs to be very compelling to justify refinancing.

Factor #4: Fees and Closing Costs (You’re Paying Either Way)

Typical refinancing costs can include:

- Application and origination fees

- Appraisal

- Title and recording fees

Some lenders advertise “no-cost” refinancing. What that usually means is the fees are baked into a higher interest rate. You’re not avoiding the cost. You’re spreading it out over time.

That can still make sense in certain situations. The key is knowing which version you’re choosing and why.

Factor #5: Your Actual Goal (Monthly Relief vs. Long-Term Savings)

This part gets skipped too often.

Refinancing can:

- Lower your monthly payment

- Reduce your total interest paid

It rarely does both in a meaningful way.

Lower monthly payments can make sense if:

- Cash flow is tight

- You’re supporting kids, parents, or both

- Income is variable

Long-term savings tend to make more sense if:

- Income is stable

- Retirement timing matters

- You want fewer years of payments hanging over you

Neither goal is “wrong.” But confusing them leads to bad decisions.

Who Refinancing in 2026 May Not Be Worth It For

Refinancing may not make sense if:

- You plan to move soon

- Your credit score isn’t ready yet

- You’re very late in your mortgage, with little interest left to save

- Fees outweigh realistic savings

Sometimes the smartest move is leaving things alone.

The Bottom Line

Refinancing your mortgage in 2026 could save you money, but only if the math works for your situation. Lower rates alone aren’t enough. Credit score, loan term, fees, and how long you plan to stay in your home all matter more than the headline number.

This won’t fix the housing market. But done thoughtfully, it might make one part of your finances less expensive or at least less annoying.