Buying a house is a major life milestone. However, few people factor in the costs of actually owning one.

While making payments toward the ownership of a home can be a good investment in the long term, your asset can turn into a liability if you fail to account for unexpected costs that often come with taking on such a big commitment.

Being house poor refers to a situation where an individual or household spends more than 30% of their income on housing costs.

As a result, many people have found themselves house poor, as a large chunk of their income goes to paying the mortgage and keeping a roof over their heads.

What are the Stats on Being House Poor?

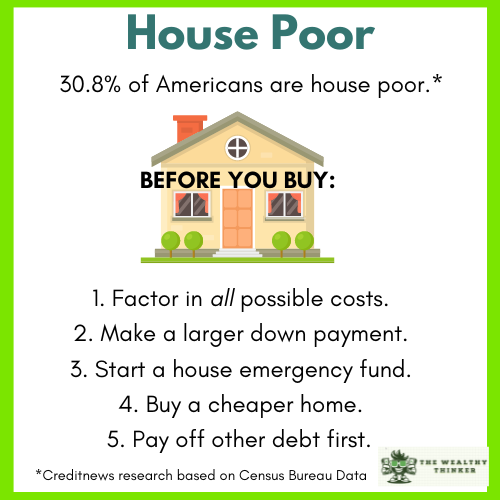

According to a Creditnews Research report based on the 2024 Census Bureau data, 30.8% of Americans are house poor, with 37.2% of homeowners with a mortgage and 20.8% of homeowners without a mortgage.

Home sale prices in the United States have increased by a staggering 95% over the last decade.

Within the last year, house prices have shot up by 4.7%. As home prices continue to escalate due to inflation, a lot of people will find themselves either unable to buy a home or afford the one they are living in.

In a recent survey, 28% of home buyers believe that making their monthly mortgage payments will be among their biggest financial stressors for the next two years.

While the prevailing economy seems to be robbing many of their dream of owning a home, there are several tips that prospective homeowners can apply and avoid being house poor.

If you find yourself house poor, there are strategies you can consider to claw your way back to financial sufficiency. Let’s have a look at these tips and strategies below.

What Does it Mean to be House Poor?

Being house poor refers to a situation where an individual or household spends more than 30% of their income on housing costs. These costs could come in the form of mortgage, rent, maintenance, insurance, or property taxes.

This means there is little left in the budget after house costs have been settled. In essence, the income is enough to put a roof over the individual’s head, to the detriment of meeting other responsibilities.

House poverty severely limits your ability to:

- build savings

- invest

- plan for retirement

- pay off debt, travel

- or enjoy other pleasures of life

It puts a lid on what you can achieve in other aspects of your life.

First Time Home Buyer? Top 5 Tips, 4 Costs to Consider & 4 Questions to Ask First

5 Tips to Avoid Being House Poor

1. Factor in all possible costs

One of the major reasons why people end up being house poor is their inability to factor in the true cost of owning a home.

Most people focus on the costs of paying for a house. They do not make provisions for:

- maintenance

- property taxes

- insurance

- home improvement costs, etc.

As a result, they find themselves caught in a crossfire because their income cannot cater to these added expenses while also trying to meet other responsibilities.

One way prospective homeowners can factor this is using the 28/36% guideline.

This is where you aim to pay:

- no more than 28% of your gross monthly income to your housing costs and

- no more than 36% towards your total existing debts, including your housing costs (Your Debt-to-Income (DTI) ratio)

The 28/36% ‘rule’ is a guideline mortgage lenders use to determine affordability when you buy a home, so people aren’t overextending themselves financially. It aims to give a realistic perspective of how much it would take them to own a home without hurting their finances.

2. Make a larger down payment

Putting down a large amount as a down payment for your house reduces the chances of your house turning into a liability.

First, it reduces your overall interest payment. This in effect lowers your monthly mortgage bill because the lower your debt, the less you have to pay.

You can also eliminate private mortgage insurance with a 20% down payment. This saved income can have a significant long-term effect on your finances because it frees up cash which can be channeled to other profitable ventures.

3. Start a housing emergency fund

Any financial advisor will tell you it’s a good idea to put extra cash away for house emergencies.

No one knows when life decides to throw us a curveball. Though your present income can sustain your housing costs, unexpected events can make the future look gloomy.

Building up emergency savings serves as a backup plan when things go south (for example if you lose your job) which makes sustaining your present lifestyle very difficult.

4. Buy a cheaper home

Your first home does not mean it will be your last.

You can always go for a less expensive home to make your housing costs more affordable. As you build up your cash reserves and the value of your home goes up, it could later be easier to move to a much bigger house.

A single-family home, condominium, or townhouse is a good place to start while you build up your finances to buy your dream house.

5. Pay off other debt before purchasing your home

Most people own a house by taking out debt (mortgage).

Before committing to taking a mortgage whose payments can stretch for as much as 30 years, it would make sense for you reduce the other existing debts.

By paying off existing debt, you’re reducing the amount of money you’d pay in interest. You’re also giving your income more ‘breathing space’ to meet other life obligations because of the cash saved from paying off your debt earlier.

For example, you can save towards your kids’ education while paying the mortgage because you’ve paid off your car loan or credit card debt. Setting up a debt reduction plan is a good strategy for every prospective homeowner who wants to avoid being house poor.

5 Critical Things You Need to Know About Qualifying For a Home Loan

What to Do if You are House Poor

You might find yourself in a situation where you already know you’re struggling and need to figure a way out.

If you find yourself house poor due to an unfortunate series of life events, there are ways you can claw yourself out of this financial quicksand.

1. Sell things you don’t need

You can raise extra cash by selling items in your possession that you don’t need.

This allows you to have some money for your other goals, and it also leaves extra which can be channeled towards your housing costs.

2. Start a side hustle

You can also start a side hustle to bring in some cash to augment the income from your primary source.

If you have skills or passions, find a way to monetize them. For example, you could become a professional dog walker, or sell items on eBay. You can also consider renting out your car if you don’t use it much.

Since you are strapped for cash, it would be best to look for home business ideas that you can do online to reduce your business costs.

3. Find a second job

If you’re not the business type, a viable option is getting a second job.

You can take up jobs that are closer to your home to reduce transportation costs. Perhaps you can work extra shifts in your current place of work if allowed.

4. Cut back on your spending

One of the first places to start to free up cash is from your spending.

Find creative ways to reduce your spending so you can have some extra savings. A budget sheds light on grey areas in your spending by helping you identify expenses you don’t need and canceling them out.

5. Rent out a room in your house

Renting a room in your house has always been a go-to alternative for people wanting to raise extra income.

If you live alone in a 3 or 5 bedroom house, you can rent a room or two to raise some money. You also get to share utility bills such as electricity, heating, etc. which reduces your expenses for the month.

If you don’t want a long-term tenant, you can consider renting a room on Airbnb for a short-term stay.

6. Move to a smaller house

This should be a last resort if other measures fail.

Owning a home goes beyond owning the building. It comes with other social perks such as the type of community, schools that children go to, social status, etc.

As such, a home is to some extent an extension of our personality. However, when faced with dire financial situations, the best bet may be to sell your beloved house and move to a smaller, more affordable home.

As harsh as it seems, it is better to have a roof over your head than none at all. It can also be the move you need to reduce debt stress and free up your finances for other profitable ventures.

7. Refinance your mortgage

If you have had your home and mortgage for some time, mortgage interest rates may have changed to your benefit. You could also have equity in your home, which is the difference between how much you owe on your home and how much it’s actually worth.

These factors alone can add up to you both paying less per month on your mortgage and less interest over time, which can really add up. If you had to get a loan insured by the FHA when you purchased, you may also be able to drop that mortgage insurance payment if you’ve reached 20% equity in your home.

Because the mortgage rates have been climbing over the past 4 years from an historical low of 2.96% in 2021 to an average of around 6.26% right now, it may not be an ideal time to refinance if you expect a lower interest rate.

Crunch some numbers on a Mortgage Refinance Calculator before you go down this road. You can at least get a sense of whether or not it’s worth your efforts and any fees to go ahead.

Key Takeaways on Avoiding Being House Poor

To a point, being house poor is an avoidable scenario with proper planning.

It entails knowing what you can presently afford and not exceeding your limit. Just because the lender is willing to loan you a huge chunk of money does not necessarily mean you should take it.

A house is an asset, but it could also turn into a liability if it takes a huge bite of your income. If you can’t afford to buy a home, it is okay to rent, however, whatever you choose, you should make sure that you can afford it.

The rule of thumb suggests that you should not spend more than 30% of your income on housing costs. Planning your housing expenses with this parameter can help you avoid paying more than you can.

Updated from May 22, 2024