Listen, a lot of people have trouble getting by, and are living from paycheck to paycheck. It can feel like worry and uncertainty about money will never end.

In a December 2023 Forbes Advisor survey, 40% of respondents claimed they were living paycheck to paycheck, and almost 30% of respondents said they weren’t even making enough to cover their standard expenses.

Living paycheck to paycheck is not only stressful, but it can also make it hard to reach financial goals like:

- paying off debt

- getting a home

- having enough money to be financially free in retirement

But it’s not impossible to break out of this loop. You can take charge of your finances and set yourself up for a more safe and secure future with careful planning, discipline, and smart money moves.

We’ve collected some helpful strategies to help you escape the paycheck to paycheck cycle. Don’t feel overwhelmed! Even trying one thing on the list can help you get ahead.

Start slowly, but stick to it – it all adds up.

Stress about money can hurt both your mental and physical health. It can make it hard to sleep, and encourage unhealthy ways to deal with problems or strain relationships.

What are the consequences of living paycheck to paycheck?

Living paycheck to paycheck can have a range of negative consequences that impact various aspects of your life. Here are some of the common consequences of this financial situation.

1. Financial stress.

Constantly thinking about how to pay for basic needs and not knowing if you will have enough money to do so can cause a lot of stress and anxiety.

2. Lack of savings and emergency fund.

If you can’t save money, you might be stuck when it comes to things like medical problems, car repairs, or losing your job. This can cause people to borrow money, build up debt, or take out high-interest loans.

3. High debt levels.

When you live from paycheck to paycheck, you often have to use credit cards and loans to pay for things. This can lead to a lot of high-interest debt that is hard to keep track of and pay off.

4. Limited financial opportunities.

If you don’t have enough money, you can’t do things like invest, boost your education, start a business, or make long-term financial plans.

5. Limited retirement savings.

If you can’t save for retirement, you might find it hard to keep up the same level of living when you leave.

6. Health and well-being.

Stress about money can hurt both your mental and physical health. It can make it hard to sleep, and encourage unhealthy ways to deal with problems or strain relationships.

7. Career limitations.

If you don’t have enough money, you might not be able to get the education, training, or certifications that could help your job and income.

8. Limited recreational and leisure activities.

Because of money, you might miss out on experiences, hobbies, and things that are good for your overall health.

9. Housing and living conditions.

If you live paycheck to paycheck, you might not have as many housing choices, which could lead to less-than-ideal living conditions or moving around a lot.

10. Inability to build wealth.

If you can’t save and spend, you might find it hard to build wealth over time. This could make it harder for you to reach your financial goals and have a comfortable future.

11. Delayed life milestones.

Because of money problems, important life events like getting married, having kids, or buying a house may have to be put off.

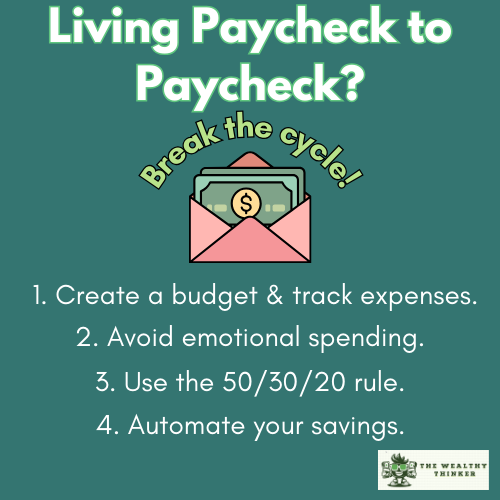

How to stop living paycheck to paycheck?

1. Create a budget and track expenses.

Make a detailed budget that lists all of your monthly costs, including fixed bills and spending you choose to do.

Keep careful track of your spending to find places where you can cut back and save. This knowledge can help you make smart choices about your money.

2. Automate savings.

You should not only set aside money for savings in your budget, but you should also treat savings as an important cost.

If you wait to save money until after you’ve paid all your bills and bought everything you need each month, you may find you have nothing left.

Instead, set up a regular transfer from each paycheck to a savings account. Then, use what’s left to build the rest of your cash.

In other words, make sure you get paid first.

Split Direct Deposit: 5 Benefits to a Simple Savings Plan→

3. Build an emergency fund.

Set up an emergency fund with enough money to cover basic costs for three to six months.

This fund is like a safety net in case something unexpected happens, like a medical emergency or losing your job. It keeps you from having to use credit or getting deeper into debt.

4. Use the 50/30/20 rule.

The 50/30/20 rule is a suggestion that can help you set up a balanced budget and make smart choices about money.

It means:

- putting 50% of your income towards what you need

- 30% towards what you want

- 20% towards savings and paying off debt

Change the numbers to fit your goals and your finances. You can change the percentages to fit your own cash situation and goals. The important thing is to keep going in the right direction towards your cash goals.

5. Reduce debt.

Pay attention to paying off debts with high-interest rates, (like credit card bills) as quickly as you can.

Pay off debt with any extra money to reduce interest payments and have more money for savings and investments.

6. Increase your income.

Look for ways you can make more money.

This could mean asking for a raise, getting a second job or doing independent work, selling things you no longer need, or learning skills that can help you get better-paying jobs in the future.

7. Set financial goals.

Set both short-term and long-term goals for your money.

Having clear goals like these can give you motivation and direction for your financial decisions:

- paying off a particular debt

- saving for a down payment on a house

- building a retirement fund

If you know what your goal is, it can help you keep your eye on the prize.

It can seem totally overwhelming when you are just struggling to pay everything off – where do you start?

Having even one simple goal to work towards can help you build your confidence as well as your bank account.

8. Avoid emotional spending.

If you don’t have to buy something right away, wait a day or two.

This can stop you from buying things on the spot and give you time to think about whether you really need them. Be aware of what makes you want to spend too much, like worry, boredom, or retail therapy.

Find better ways to deal with your feelings, like going for a walk, reading a book, or practicing awareness.

9. Live below your means.

Change your habits so that you can spend less than you make.

Don’t let your lifestyle get more expensive as your income goes up. Instead, keep living simply and put the extra money into savings and investments.

You CAN Stop Living Paycheck to Paycheck

By using these tips and being responsible with your money, you can slowly break out of the cycle of living paycheck to paycheck and work towards financial stability and freedom.

It may take time and work, but it will be well worth it in the long run.