Talking about money is a very sensitive and uncomfortable issue for most people.

A lot of parents choose to avoid having the conversation about money with their kids.

However, to not teach your children about money and shielding them from money discussions could put their financial future at risk. As a parent, you want to lay a foundation for your kids which will give them a head start.

Kids, on the other hand, are eager for their parents to share their wisdom.

In a Kansas City study that interviewed 300 teens about what they wish their parents had taught them, more than half of those surveyed wished their parents taught them more about money.

Similarly, a T. Rowe survey on Kids, Parents & Money discovered that 85% of parents thought it was important to talk to their kids about saving and spending money, but only 22% of them actually spend time discussing it on a weekly basis.

If you don’t want your children to make the same financial mistakes as you did, it is important to play a key role in shaping your children’s feelings, thinking, and values about money.

The question, then, is how do you teach your children about money?

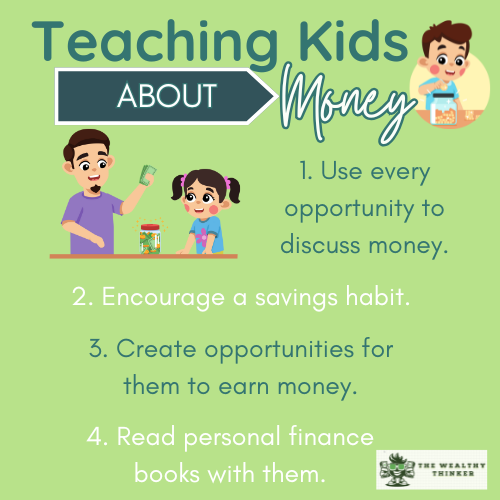

6 Excellent Tips to Teach Your Kids About Money

1. Use every opportunity to discuss money.

There is no such thing as a perfect time to discuss money with your kids.

There are always opportunities that present themselves which can be used as learning points. A visit to the mall, ATM, or toy shop can be used to teach a lesson or two.

Try to use examples from your personal life or that of others. Let them know your financial mistakes or success, and what lessons can be drawn from such experiences.

2. Encourage a savings habit.

Teaching your kids how to save at an early age helps them develop a sense of value for money.

Being instinctive, children are likely to spend their money on frivolous things. Try letting them understand that money isn’t meant for just spending but should be saved too.

Instilling a habit of savings in your kids helps them develop essential habits such as discipline and delayed gratification which are critical for money management.

You can start by giving them a piggy bank where they can save coins or cash given to them as gifts or tips.

A more likely successful approach is attaching the savings to short-term goals such as saving to:

- get a toy they have their eye on

- see a movie

- buy tickets to a game of their favorite sports club

This will help to form the necessary building blocks to be able to take on larger challenges such as saving for college, first car, or a house.

3. Create opportunities for them to earn money.

Another way to teach your kids about money is by making them earn it.

Let your kids run some errands or do certain chores and get paid for it. This does not imply doling out cash anytime they do something for you or turning them to domestic staff.

Admittedly, there are house chores that kids have to do without pay because it’s what’s expected of them as members of a family. But, at certain times, you can attach monetary benefits to certain tasks.

A good trick is by getting them to carry out a chore if they want extra money from you.

Alternatively, rather than pay others for a service (like shoveling snow or doing yardwork.), you can have your kids carry out the task and get paid for it. You can draw up a list of small chores they need to complete weekly and place them on salary.

This can teach your kids the important lesson of earning money through honest work.

More importantly, it will help them develop entrepreneurial skills and an understanding of how to value their time and energy and the best ways to deploy it.

4. Teach them about budgeting.

Teaching your children how to create a budget is a practical step towards money management.

A budget lets your kids understand that money is not an infinite resource and has to be adequately managed. As such, rather than spending their money on frivolous items, they might cherish every penny they are able to save.

Budgeting also enables them to better allocate money by prioritizing their needs, an attribute that will equip them later in life in setting and working towards long-term goals.

By budgeting, your kids will understand that life is not always rosy, as there will be rainy days – and the best antidote against a rainy day is being prepared.

Early budgeting skills will train your kids to be frugal with their money and live within their means. This can be a huge help to them avoiding taking on debt later in life.

Budgeting 101: What are the Basics of Budgeting You Should Know?

5. Show them how compound interest works.

Teaching your kids how to save is important, but showing them how their money can be put to work broadens their perspective on how to manage money better.

There is no better way to show your children the benefits of investing than explaining how compound interest works. Albert Einstein described compound interest as the 8th wonder of the world. This is because of its ability to increase money exponentially.

A simple way to teach your kids about compound interest is by explaining how the Rule of 72 works. This rule shows your kids how many years it would take for their investment to double.

This will let them see the value in investing small amounts of money consistently and the impact this will have on their finances in the later stages of their life.

The Power of Compound Interest: How it Works, the Good & the Bad

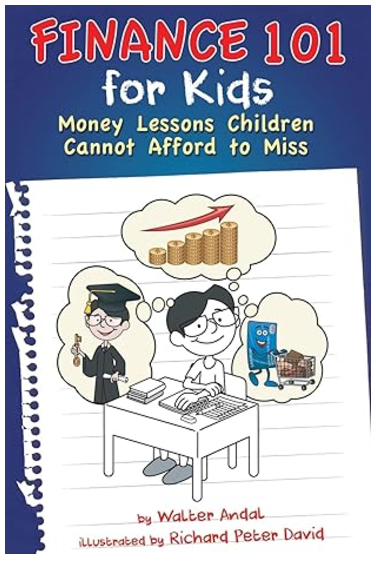

6. Get them personal finance books.

Finance books help your kids grasp the basics of money management.

They come highly recommended because your kids can always refer to them if they’ve forgotten a lesson. They’re also helpful for the parent that is not versed in financial literacy.

The anecdotes and lessons contained in the books are immersive because, by reading, kids can see through the character’s eyes and gain a better understanding of how to make profitable financial decisions.

Books are also a less expensive way to learn about finance and money management. There are finance books that cater to just about any age from kindergarten to teenager.

by

Frustrated by the lack of resources that apply the concept of finance to real life situations for his own children to learn from, author Walter Andal was inspired to create an informative and entertaining book to help children get on the right path to making smart personal financial decisions.

In Finance 101 for Kids, children and parents will explore:

- How money started

- How to earn and make money

- Saving and investing

- What credit is and the dangers of mishandling credit

- What the stock market is

- Economic forces that can affect personal finance

- What currencies and foreign exchanges are

- The importance of giving back to the community

Perfect for kids aged 8 to 13, Money Skills for Kids is an educational tool – that takes the reader on the journey through the maze of money management, transforming them into savvy savers and wise spenders.

Here’s a sneak peek at what’s inside:

- Unravel the mystery of earning and spending money wisely

- Learn how to transform a brilliant money-making idea into reality

- Master the art of saving with easy and effective strategies

- Take the first step in banking by choosing and opening a savings account

- Set and achieve financial goals like a pro

- Learn the crucial difference between needs and wants

- Dip your toes into the fascinating world of investing

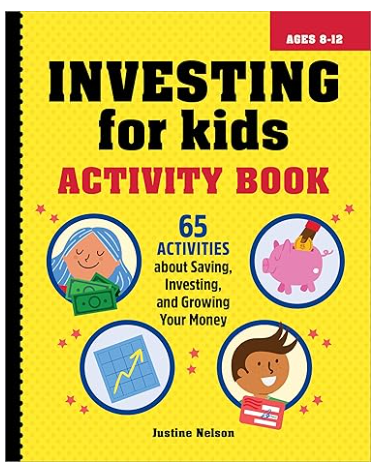

Help your child become a financial whiz kid―for ages 8 to 12.

It’s never too early to set children on the path to financial literacy. The Investing for Kids Activity Book, a companion to Investing for Kids, teaches them how to become savvy with their finances. Through educational and engaging exercises, they’ll learn how to track their spending, make good investments, and more.

- Build a financial vocabulary―Your kid will sound like a finance pro as they learn all sorts of important financial terms like mutual funds, debit vs. credit, and simple interest vs. compound interest.

- Explore engaging activities―They’ll develop their money management smarts through 65 awesome exercises like figuring out what type of spender they are and determining their saving goals.

- Discover shrewd tips―Help your kid find advice on the best ways to handle their personal finances, from the benefits of setting a budget to the importance of diversifying their investments.

Disclosure: As an Amazon Associate, we earn a commission when you click the link and finalize a purchase (At zero cost to you.). We participate in programs like these to keep providing our readers free daily motivational content.

Money apps for kids

Technology plays an integral part in the life of today’s kids.

What better way to teach them about finances than leveraging digital tools? There are several money apps designed to teach kids the basics of personal finance and money management.

Apps such as RoosterMoney, Gohenry, or Bankaroo have a variety of features that can help your kids with budgeting, accounting, and planning.

Be a role model

There is no better way to teach your kids about personal finance than being a role model yourself.

Kids are quick to pick up the traits and mannerisms of their parents. If you want your kids to be better money managers, then you have to show them how it’s done through your own behavior.

Your actions have to match your words. They need to see you making smart spending, saving, and investment choices. Seeing their parents display financial literacy makes it easy for them to replicate the same attributes in their life.

It helps their young minds develop the realization that is possible to manage and grow money.

For example, the next time you’re looking for a new appliance, invite your kids to do the research with you. Show them how to compare prices but also how value plays in.

- How do you know what something is worth?

- Is it smart to use points or look through flyers to find a good deal?

Kids will pick up on this method.

Such a positive mindset about money puts them on track to financial independence and dispels the usual narrative that money is evil and hard to grow.

The Bottom Line: Teach Your Children About Money Early

Apart from good character and values, teaching your kids about personal finance and money management is perhaps the best legacy you can leave for your kids.

It places them ahead of the curve and gives them the understanding needed to avoid making the same financial mistakes as their peers – and parents.

We are all familiar with stories of rich kids who blew their inheritance because they didn’t have the necessary money management skills.

Having the money talk may be difficult and uncomfortable, but if you factor in the potential gains and benefits for your kids, then it is a discussion worth having.

Editor’s note: This article was originally published Oct 15, 2021 and has been updated to improve reader experience.