It’s three days before payday, your car just broke down, and your landlord is breathing down your neck for rent.

Suddenly, you see a glowing sign: “Payday Loans! Cash Now!”

It seems like the answer to your prayers, right?

Hold onto your wallet, folks, because we’re about to dive into the murky world of payday loans and why they might be more like financial quicksand than a life raft.

What Exactly is a Payday Loan?

Before we start pointing fingers, let’s break down what a payday loan actually is:

- A short-term, high-cost loan, typically for $500 or less

- Usually due on your next payday (hence the name)

- Requires you to give the lender access to your checking account or write a post-dated check for the full balance

Sounds simple enough, doesn’t it? Well, not so fast…

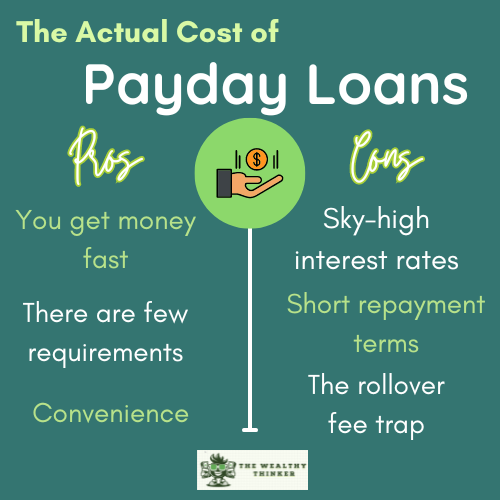

The Bait: Why Payday Loans Seem Attractive

- Speed: You can get cash in your hand quickly, often within 24 hours.

- Few Requirements: No credit check? No problem! Most payday lenders don’t check your credit score.

- Convenience: With storefronts in strip malls and online options, payday loans are easy to access.

But remember, if something seems too good to be true, it probably is. Let’s peel back the layers and see what’s really going on.

The Switch: The True Cost of Payday Loans

Here’s where things get ugly.

Payday loans come with some serious strings attached:

- Sky-High Interest Rates: We’re talking Annual Percentage Rates (APRs) of 400% or more. For comparison, even high-interest credit cards usually top out around 30% APR.

- Short Repayment Terms: You typically have to repay the loan in two weeks. If you couldn’t afford your expenses before, how likely is it that you can repay the loan plus interest in such a short time?

- The Rollover Trap: Can’t repay in time? No worries, says the lender, just roll it over to the next payday… for another fee, of course. This is how people get stuck in a cycle of debt.

Let’s crunch some numbers:

Say you borrow $300 with a $45 fee.

In two weeks, you owe $345. That doesn’t sound too bad, right?

But look at it this way: that $45 fee on a two-week $300 loan equates to an APR of 391%! If you had to roll over that loan for a year, you’d end up paying $1,170 in fees alone – nearly four times what you borrowed!

The Cycle of Debt: Why Payday Loans Are So Dangerous

Here’s the thing: payday loans are designed to keep you coming back. It’s not a bug, it’s a feature. Here’s how the cycle typically goes:

- You take out a payday loan to cover an emergency expense.

- Two weeks later, you can’t repay the full amount.

- You pay a fee to roll over the loan.

- The cycle repeats, with fees piling up each time.

Before you know it, you’re trapped in a cycle of debt that’s hard to escape. It’s like financial quicksand – the more you struggle, the deeper you sink.

The Bigger Picture: Why Payday Loans Exist

Now, it’s easy to villainize payday lenders, but the truth is more complex. Payday loans exist because:

- Many people lack access to traditional forms of credit.

- Unexpected expenses can throw even careful budgeters off track.

- Some people lack financial literacy and don’t fully understand the terms they’re agreeing to.

The real problem is a system that leaves many people living paycheck to paycheck, without a financial safety net.

Breaking Free: 7 Alternatives to Payday Loans

So, what can you do if you’re in a financial pinch? Here are some alternatives to consider:

- Negotiate with Creditors: Many are willing to work out a payment plan if you’re proactive.

- Credit Union Loans: Many offer small, short-term loans at much more reasonable rates.

- Paycheck Advance Apps: Some apps allow you to access your earned wages before payday for a small fee.

- Local Nonprofits and Charities: Many offer emergency assistance for things like rent or utilities.

- Side Gigs: In today’s gig economy, there are many ways to earn quick cash, from food delivery to online freelancing.

- Borrowing from Friends or Family: It can be awkward, but it’s usually interest-free.

- Credit Card Cash Advance: While not ideal, it’s usually cheaper than a payday loan.

Protecting Yourself: Financial Health Tips

The best defense against payday loans is a good offense. Here are some tips to shore up your financial health:

- Build an Emergency Fund: Aim to save 3-6 months of expenses. Start small if you need to – even $500 can help in a pinch.

- Create a Budget: Know where your money is going and where you can cut back if needed.

- Improve Your Credit Score: This can help you qualify for better loan terms in the future.

- Seek Financial Education: Many nonprofits offer free financial literacy courses.

- Consider Credit Counseling: A credit counselor can help you develop a debt repayment plan and budget.

The Bottom Line: Stay Out of the Trap

Payday loans might seem like a quick fix, but they often lead to long-term problems.

If you’re considering a payday loan, take a step back and look at all of your options. Remember, there’s no financial problem so urgent that it’s worth trapping yourself in a cycle of high-interest debt.

If you’re already caught in the payday loan trap, don’t despair!

Reach out to a credit counselor, consider debt consolidation, and start building your emergency fund as soon as you can. It might be a tough journey, but financial freedom is worth the effort.

In the end, the best payday loan is the one you never have to take. Stay informed, plan ahead, and remember: your financial health is worth more than any quick fix.