Dealing with money covers a lot of emotions.

So of course, any kind of financial stress – whether it’s an abundance or lack thereof – is bound to have an effect on your mental health!

It’s a complex relationship, one with many contributing factors that might feel totally out of your control.

If your mental health is negatively impacted by money, you’re not alone.

Research has shown that finances are the number one cause of mental stress, more often than politics, work, or family. According to a March 2022 survey carried out by The American Psychological Association, 72% of Americans report stressing about money at least some of the time.

Given the current economic situation, there is bound to be a lot of anxiety over money and how it should be spent.

Living costs are rising, while the value of money is on the decline. This has forced people to cut down on their spending for the holidays, postpone retirements, and have household debt shooting through the roof. Given this, of course many people are worried about the state of their finances!

In this article, we’ll look at how money may impact your well-being, decisions, and relationships with it.

We’ll also look at ways to reduce the impact of money on your mental health which can help you live a more balanced life.

Examples of How Financial Stress Can Affect Your Mental Health

Thinking about money can be emotional, and you might have conflicting feelings about it.

Here are some common ways money can affect your mental health:

- Money worries can interfere with sleep.

- You might not be able to afford the necessities for your well-being. Housing, food, water, heating, or medical services like therapy and medication may fall under this category.

- Overspending when you are unwell.

- Feeling bad about spending money (even though you can afford it) or asking for help (even though you know you need it).

- Fear of looking at your bank balance or speaking to the bank.

- Feeling guilty for requiring assistance.

- Feeling stressed if you’re under a lot of pressure to support yourself and others.

- Feeling tired or worn down if you’ve been struggling with money problems for a long time.

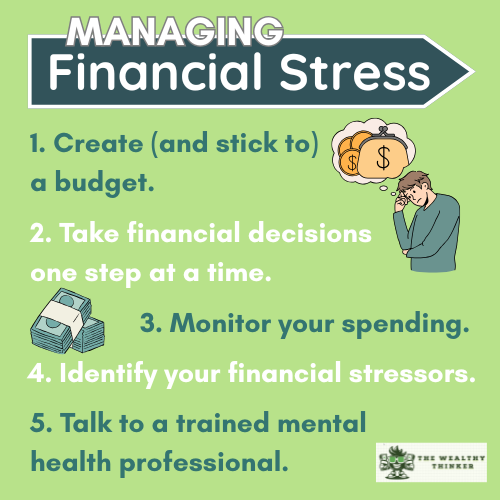

7 Ways to Reduce the Impact of Financial Stress on Your Mental Health

To help you become more focused and in charge of your life, it is possible to create a solid mental fitness strategy.

These tips will assist you in alleviating the negative effects of financial stress on your mental health.

1. Take financial decisions one at a time.

The stress of money can be extreme.

When you have to make several decisions at once, you’re more likely to make a snap decision. Focus on one financial choice at a time, if you can.

2. Create (and stick to) a budget.

It’s challenging to create goals when you don’t know where to begin.

Conduct a financial audit. Then, make your budget. Try to consider behavioral modifications that will help you adhere to your budget after you’ve developed one, like not shopping when you’re stressed or putting some savings in your emergency fund as soon as you get paid.

3. Monitor your spending.

A way to avoid the mental stress that comes with money is to monitor your spending. This might seem counterproductive, but knowing where your money is going will help you feel more in control.

Keep a close eye on your spending patterns. Use your judgment when making decisions about where your money is going!

This ensures you don’t overspend and feel guilty afterward. It also ensures that your money is allocated to your needs.

4. Identify your financial stressors.

Certain monetary issues trigger anxiety and fear in us.

Perhaps you get overwhelmed when you get a bill in the mail. Or the stress comes at the end of the month, when you wonder if your next paycheck can cover your upcoming rent. Whatever your stressors are, get to know them.

This way you know how to handle them – and ultimately, to control your anxiety or fears.

5. Recognize the emotions you feel related to money.

Get in touch with your emotions in a similar way to understanding your pressures.

Consider what feelings may arise concerning finances and money. Occasionally, writing down your feelings in a journal will enable you to identify them.

Include constructive coping strategies in your mental fitness program.

For example, if you notice you feel dread when you look at your bank statement, stop to consider why.

Are you freaked out about what it will say? (This is common.)

This could be because you avoid it, which means you don’t have any idea how much you spent or what bills were paid. So you avoid it, knowing you shouldn’t…and the cycle repeats itself.

Downloading an app like Spendee or You Need a Budget that tracks your budget for you could help. Some of them provide a notification when you get close to your budgeted amount for the month. (This could also cause more stress, but it depends on the person.)

Your overall level of self-care should be reflected in your mental fitness.

6. Have a mentor.

Having a mentor (dead or alive) is a good way to deal with the mental stress that comes with money.

This helps you know that your money problems are not exclusive to you, as they have been experienced by other people. So, it can be comforting to know that other people have overcome financial difficulties. This gives the assurance that your problems are not impossible to overcome.

7. Talk to a trained mental health professional.

Speak with a physician or qualified mental health professional if you are dealing with a mental health issue.

You might be experiencing mental health issues for the first time.

Or perhaps you’ve seen that your symptoms are getting worse as a result of your financial condition. In any case, look for assistance.

This is why those services are offered! You don’t need to figure it all out on your own, and there may be underlying issues related to your stress around money you aren’t even aware of.

Financial Stress: Get to Know Your Money & Mood Patterns

Consider spending some time reflecting on how and why you feel about money. If you battled with money in the past or had limited resources as a child, for instance, this may have an impact on how you feel about money today.

You might try responding to these queries:

- Do you tend to save money at particular seasons of the year?

- How do you feel after making a purchase?

- Do you experience distinct emotions when you spend and save money?

- What thoughts and sentiments come to mind when you consider money?

- What components of money management worsen your mental health? For instance, it could involve things like keeping appointments, reading mail, facing conflict, or being misunderstood.

Maintaining a spending and mood diary in which you note your purchases and their justifications may be helpful. You might also keep track of your pre and post-reaction emotions.

After completing this, you can begin to feel as though you have a better understanding of your financial habits and tendencies. Knowing these could make it easier for you to prepare for challenging situations. See our advice on setting money aside in advance.

Financial Stress Can Be Managed

Financial difficulties and troubles are commonplace.

In reality, we are aware of the close connection between financial difficulties and mental health. Financial stress can definitely worsen a person’s mental health and vice versa. It’s a vicious cycle that frequently leads to economic hardship and bad well-being.

However, you are not alone. First, take a deep breath. Your concerns about money are legitimate, but you don’t have to face them on your own.

If you have the correct assistance, you can take charge of your finances. There are many money managers and helpers out there, but sometimes you just need someone to show you the way.

Editor’s note: This article was originally published Jan 12, 2024 and has been updated to improve reader experience.

Photo by Christian Erfurt on Unsplash