A mortgage refinance can be a smart move to lower your interest rate, reduce monthly payments, or tap into your home equity – but only if you approach it with a solid plan.

Whether you’re aiming to free up cash, cut down your loan term, or consolidate debt, refinancing is a powerful financial tool that can either boost your financial well-being or create unexpected stress.

The good news?

With the right strategies, you can make the most of your refinance and come out ahead.

From improving your credit score to choosing the right loan structure, these six actionable tips will help you navigate the mortgage refinance process with clarity and confidence – so you can build a more secure financial future on your terms.

Read this next: How to Know You Need Help Managing Your Debt

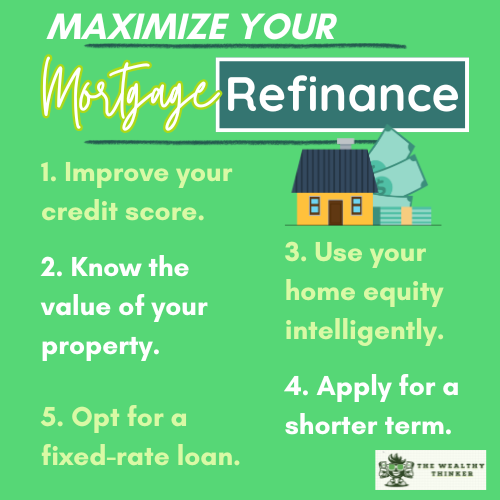

6 Helpful Tips on How to Get the Best Out of Mortgage Refinance

1. Improve your credit score.

Your credit score determines the interest you’ll be paying on your loans.

If you’re refinancing your mortgage, your goal should be getting a reduced interest rate on your monthly payments. One way this can be achieved is by improving your credit score.

This makes you look more creditworthy in the eyes of the lender, which can then result in reduced interest rates.

A one-point increase on your credit score increase could reduce your mortgage fees by one percentage point.

That’s $100 for each $1000 borrowed. To have a clear picture of your credit score, you can request a report from any of the credit reporting agencies.

2. Know the value of your property.

If you don’t know the current value of your home, you could be paying too much to refinance your mortgage.

Your home equity determines how much money you can receive to refinance your existing loan. Less home equity reduces your loan-to-value ratio which could translate to higher rates.

Adequate equity can get you a lower interest rate and eliminate extra costs such as private mortgage insurance.

There are several ways you can get a realistic estimate of your home’s value.

You can meet with your local real estate agent and request a Broker’s Price Opinion (BPO) or Comparative Market Analysis (CMA).

You only have to pay an appraisal fee, a small sacrifice compared to the additional costs you would be paying if you don’t value your home properly.

3. Use your home equity intelligently.

You can tap into your home equity to increase your credit score, but also cash flow pipelines.

Many people use their home equity loans to fund emergencies or short-term needs. While this can certainly be helpful, it still puts them deeper into debt until they can recoup or pay the debt back.

A different way to make optimal use of your home equity is by using it to invest or start up a business. (Although you can’t guarantee the success of either, both are capable of turning a profit.)

The extra cash that comes from the investment or business can be used to make mortgage payments, and increase your credit score and net worth. When the lender considers your assets, cash flow, and improved credit score, this can get you a lower interest rate on your refinancing.

The Home Equity Loan: 5 Intelligent Ways to Make the Most Out of It

4. Compare and contrast.

To get the best refinancing deals, you should compare and contrast refinance rates from different lenders.

This allows you to know which rates would work best for you and get you higher value for your money.

Requesting from one lender limits your options and skews your view. Try to get quotes from as many as five lenders, then compare to get the best deal for you.

5. Apply for a shorter term.

When refinancing, you can consider applying for a shorter loan term.

This allows you to pay off the debt faster and at a much-reduced cost because you pay less interest during the span of the loan.

For example, refinancing from a 30-year mortgage into a 15-year loan, you pay only half the interest – which reduces the overall amount you would pay.

The only downside is that the monthly payments will increase, but if you consider time as a valuable resource, this may be a small price to pay for owning a home.

6. Opt for a fixed-rate loan.

Opting for a fixed-rate loan instead of one that is adjusted for inflation and interest rates can help you pay less when refinancing.

If your mortgage refinance is an adjustable-rate loan, interest rates may go up in the future, thereby making you pay more. However, a fixed-rate loan remains the same during the term.

This allows you to plan your monthly expenses and doesn’t put you under undue financial pressure that may come with the unpredictability of fluctuating interest rates.

The Top Benefits & Drawbacks of Fixed Rate vs. Adjustable Rate Mortgages

Making the Most of Your Mortgage Refinance: A Final Word

Refinancing your mortgage can be a way to ease the financial burden of owning a home and set up your finances for better performance.

However, the lure of getting extra cash to pay off an existing one can blind us to the obvious danger of refinancing.

Remember that your home is the collateral for the loan, so, if you don’t plan properly, you could lose it in the process.

By putting these factors into consideration, you can make the most of refinancing your home and come out financially stronger!

Editor’s note: This article was originally published Oct 4, 2021 and has been updated to improve reader experience.

Photo by Paul Kapischka on Unsplash