Stepping into the stock market can feel like entering a world of endless possibilities.

With promises of financial growth and wealth-building opportunities, it’s easy to dive in headfirst. But for beginners, the excitement often comes with costly mistakes that can set back progress or derail goals entirely.

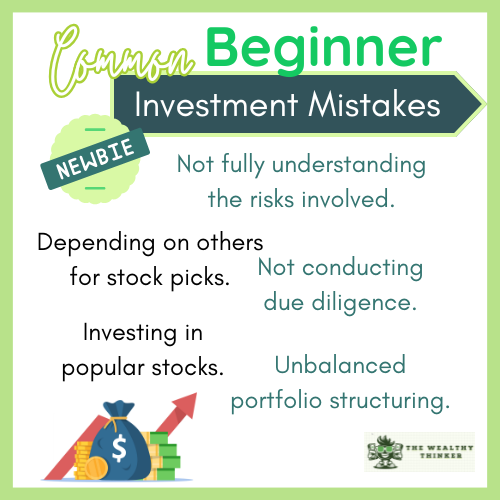

Understanding beginner investment mistakes is the first step toward avoiding them.

From underestimating risks to relying too heavily on others’ advice or failing to diversify, the missteps can quickly add up.

This article aims to help you navigate the pitfalls most new investors encounter and equip you with strategies to build a smarter, more resilient portfolio.

Ready to make your investment journey smoother?

Let’s explore the seven most common beginner investment mistakes – so you can avoid them.

7 Common Beginner Investment Mistakes to Avoid

1. Not fully understanding the risks involved.

A key to successful investing is having a proper understanding of the risks involved.

As a beginner in the stock market, it’s important to have a full picture of the risk before ‘going all-in’. There are different types of risk – market, liquidity, equity – all of which have an effect on the price movement of stocks.

Having an understanding of the risks involved will help you make more effective investment decisions and allow you to position your trades appropriately.

What’s Your Risk Tolerance? 3 Different Types & 5 Factors to Help You Determine

2. Depending on others for stock picks.

In a somewhat complicated venture like stock market investing, it’s not out of place to seek advice from people who know way more about it than you do.

The problem is that most newbies take this advice on a face level and swallow it hook, line and sinker. They don’t bother to carry out their own analysis and background checks.

The explosion of so-called finance gurus on social media is a direct fall-out from this.

A lot of people now get their investment advice from social media, which can be misleading and laced with ulterior motives. As a beginner, you have to develop the capacity to search for and pick out stocks that suit your portfolio.

Learn how to perform technical and fundamental analysis.

Understand how metrics such as Price/Earnings ratio, Return on Assets (ROA), Return on Equity (ROE), and DTI ratio can help you value a stock.

Also learn how to use technical tools such as moving averages, Fibonacci retracements, MACD Histogram, and RSI indicators to choose stocks, plus time your entry and exit into/from positions in the stock market.

Getting Investment Advice From Social Media? 4 Wary Concerns & 5 Ways to Take Advantage

3. Not conducting due diligence.

Due diligence is the act of carrying out a comprehensive appraisal of a business to ascertain its financial status and determine if it is worth investing in.

Due diligence uses a variety of metrics such as market capitalization, liquidity, earnings, guidance, analysts’ ratings, and technical analysis – to determine if a stock is a good investment.

Not conducting due diligence is pretty close to just gambling and increases your probability of incurring losses. This is one of the most common beginner investment mistakes. You are also susceptible to knee-jerk reactions because you have no underlying reason for investing in a particular stock.

4. Investing in popular stocks.

A lot of people invest in stocks that are popular or receive the most mentions on social media.

As a result, they pass up opportunities in lesser-known stocks which have the potential for high returns. For example, while most people are focused on technology stocks, small-cap stocks also offer opportunities for huge gains.

Also, when you invest in popular stocks, you’re inadvertently doing what everyone else is doing. This kind of approach severely limits how well your portfolio performs since your investment decision moves in tandem with everyone else.

5. Herd mentality.

Beginners are often lured into following the crowd.

However, seasoned investors know that the biggest payouts happen when you take a more renegade view of the market.

Beginners often make the mistake of buying when everyone else is buying and selling when everyone is doing so.

This will likely only keep you running in circles with no reasonable gains to your portfolio. It also happens when due diligence has not been conducted.

When the market appears to be moving in a certain direction, ask yourself why is this stock moving? Is it a knee-jerk reaction or fundamentally based? Questions like this help to clear the dust and clarify your investment choices.

4 Ways Social Pressure is Influencing Your Financial Decisions

6. Not defining their risk appetite.

Risk appetite is simply defined as your ability to absorb risk.

Everyone has a different threshold when it comes to risk. While some have a high-risk appetite, others are risk-averse. Risk appetite is a function of knowledge and capital.

A common mistake that beginners make is assuming that everyone has the same level of risk. It is important to understand yourself and know your risk threshold.

This will determine which type of stocks you want to invest in, and how aggressive or conservative your investment approach is.

7. Unbalanced portfolio structuring.

Portfolio restructuring and asset allocation is a risk management strategy in stock investing.

Asset allocation is the strategy of dividing your investment portfolio among different asset classes, such as stocks, bonds, cash, and other securities (real estate, commodities), to achieve a balance of risk and return that aligns with your financial goals, risk tolerance, and investment timeline.

A balanced portfolio with multiple asset types acts as a hedge in the market because the assets are diversified across sectors, lowering the risk of loss.

Investments are concentrated in particular sectors, with some stocks having a huge proportion of their portfolio. As such, when those sectors or stocks suffer huge declines, this drags their portfolio downwards.

To avoid this mistake, beginners need to ensure they’re properly structuring their portfolios.

5 Steps to Help You Create a Long Term Investment Portfolio

Key Takeaway: Learn from Beginner Investment Mistakes, and Aim to Avoid Them

Making beginner investment mistakes is a natural part of learning, but it’s far better to learn from others’ errors than repeat them yourself. Begin your investment journey with patience, preparation, and a commitment to learning.

Expose yourself to reliable resources, take small, calculated steps, and keep track of your decisions. By evaluating and improving your strategy over time, you can build a solid foundation for long-term success in the stock market.

Editor’s note: This article was originally published Oct 9, 2021 and has been updated to improve reader experience.