Credit scores can have a huge and immediate impact on your life now, but your current score can also impact your future self.

A credit score tells a lender how trustworthy you are to pay back your loans on time.

A good score indicates that you can be trusted to make on-time payments and be in good standing with that lender.

A bad score suggests that you are a risky borrower, and a lender may reject an application for a loan or give you a higher interest rate to offset that risk.

What are the Credit Score Ranges?

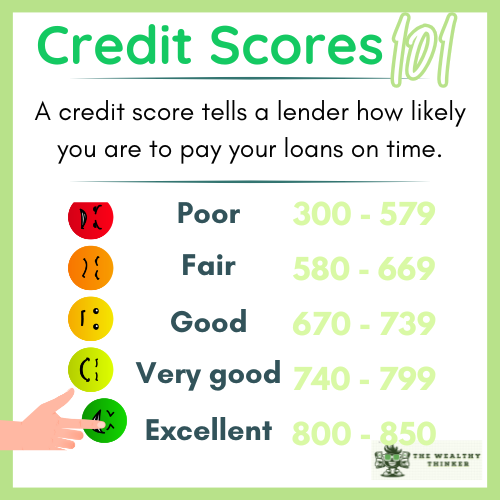

A credit score is a range from 300 to 850 and is calculated through five different categories.

850 indicates a perfect score, and 300 is the worst number to have. If your credit score is below 579, you are considered to have a lower or “bad” credit score.

A “poor” credit score ranges from 300 to 579.

You are unlikely to get approved for loans; if you do, you will have the highest interest rates.

A “fair” credit score ranges from 580 to 669.

You may be approved for more types of loans but also have higher interest rates.

A “good” credit score ranges from 670 to 739.

This is the middle of the credit score, so you’ll have even odds of approvals and mid-level interest rates.

A “very good” credit score ranges from 740 to 799.

You will be approved for most loans and have lower interest rates.

An “excellent” credit score ranges from 800 to 850.

You’ll have the highest approvals and lowest interest rates with an excellent score.

How does bad credit impact you?

The closer to “poor” your credit score is, the worse your credit is.

Conversely, even being in the “good” range can have a bit of a negative impact on your credit power.

The current impact of having a bad credit score is that you are less likely to be approved for loans. You may not be approved if you need to take out a credit card or borrow money for any reason.

If you are approved, you will be paying the highest interest rate – and you’ll be paying significantly more than someone with a lower interest rate.

There are also future considerations to have if you have a lower credit score.

First, you’ll have fewer job opportunities, especially if you’re handling money or doing any type of management. You may not be offered a job in these areas if you have a lower credit score.

You’ll also have fewer renting options.

Some apartments and private landlords run credit checks for new tenants. If your score is not good, the landlord may think you would not be an ideal tenant for their property.

If you want to buy a car or home in the future, you may also have fewer options.

You may not be able to get the house or car that you want and instead opt for a lower quality vehicle or home that you’ll be approved for. You’ll also have higher interest rates on these large purchases, which can really add up.

How does good credit impact you?

The closer to “excellent” credit scores are, the better your credit is.

You’ll have many more options and opportunities in your life with a better score.

The most immediate impact of having good credit is that you’ll have more opportunities to be approved for loans and lower interest rates. You will most likely be approved for a loan with low-interest rates if you need one.

Lower interest rates are important because you’ll pay less than someone with a higher interest rate on that same loan.

In the future, you’ll also be more likely to purchase larger items such as a house or car. As a result, you’ll be approved for a higher mortgage or car lease and have lower interest rates on these two loans as well.

Lastly, you’ll have better job prospects and renting options with a higher score. With a good score, your future employer and landlord will see you as trustworthy.

Final Thoughts on Credit Scores

It’s important to know how your credit can impact you today and tomorrow to motivate you to improve your score or to keep it high.

Don’t fret about your current or future opportunities if your score is not in one of the top ranges. You will need to fix your score, but this isn’t impossible.

There are easy ways to improve your score, like making on-time payments. A good credit score will give you more opportunities in the future. A bad one will provide you with fewer opportunities.

Editor’s note: This article was originally published Jul 26, 2022 and has been updated to improve reader experience.