Ever been called a cheapskate when you thought you were just being smart with your money?

Or maybe you’ve wondered if your penny-pinching ways have crossed a line?

Let’s dive into the world of saving and explore the fine line between being frugal and being, well, cheap.

Remember, the goal isn’t to spend as little as possible on everything. It’s to spend wisely on the things that matter most to you while finding creative ways to save on the rest.

The Frugal Fundamentals

Frugality is like a well-tailored suit – it looks good on everyone and never goes out of style. Here’s what being frugal really means:

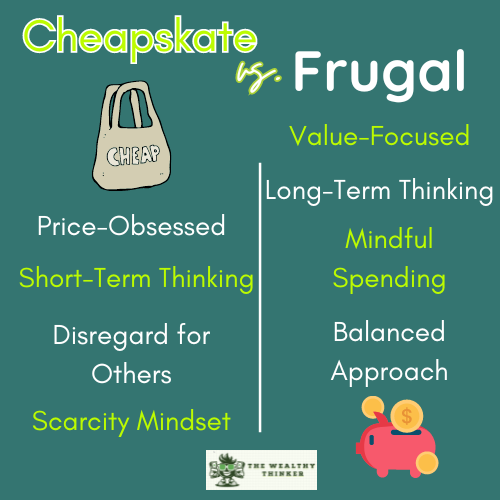

- Value-Focused: Frugal people prioritize getting the most value for their money. They’re not afraid to spend, but they want to ensure they’re getting a good return on their investment.

- Long-Term Thinking: Frugality often involves spending more upfront for quality items that will last longer, saving money in the long run.

- Mindful Spending: Frugal individuals are conscious of where their money goes and cut back on areas that don’t align with their values or goals.

- Waste Reduction: Being frugal often goes hand-in-hand with reducing waste and finding creative ways to reuse or repurpose items.

- Balanced Approach: Frugal people know when to save and when to splurge. They’re not afraid to spend on experiences or items that truly matter to them.

The Cheapskate Chronicles

Now, let’s talk about the cheapskate. Being cheap is like wearing socks with sandals – it might save you money, but at what cost?

Here’s what characterizes a cheapskate:

- Price-Obsessed: Cheapskates focus solely on paying the lowest price, often at the expense of quality or value.

- Short-Term Thinking: They’ll often opt for the cheapest option now, even if it means spending more in the long run due to replacements or repairs.

- Extreme Measures: Cheapskates might go to unreasonable lengths to save money, like reusing tea bags multiple times or taking excessive amounts of condiments from fast-food restaurants.

- Disregard for Others: Their desire to save money often negatively impacts others, like undertipping at restaurants or always expecting others to pay.

- Scarcity Mindset: Cheapskates often operate from a place of fear and scarcity, always worried about not having enough money.

Frugal vs. Cheapskate: Real-World Examples

Let’s look at some scenarios to illustrate the difference:

Scenario 1: Buying a Coffee Maker

- Frugal Approach: Investing in a quality coffee maker and making coffee at home to save money on daily coffee shop visits.

- Cheapskate Approach: Buying the cheapest coffee maker available, which breaks after a month, or continually “borrowing” coffee from the office kitchen.

Scenario 2: Tipping at a Restaurant

- Frugal Approach: Eating out less often but tipping appropriately when they do.

- Cheapskate Approach: Dining out but leaving a minimal tip or finding excuses not to tip at all.

Scenario 3: Gift Giving

- Frugal Approach: Planning ahead to buy thoughtful gifts during sales or making heartfelt homemade gifts.

- Cheapskate Approach: Regifting unwanted items or consistently giving cheap, thoughtless presents.

Scenario 4: Home Maintenance

- Frugal Approach: Regularly maintaining their home and appliances to prevent costly repairs down the line.

- Cheapskate Approach: Ignoring maintenance issues until they become major, expensive problems.

Minimalism & Frugality: How You Can Save More By Having Less

The Impact on Life and Relationships

Being frugal can lead to financial stability, reduced stress, and the ability to spend on what truly matters. It’s a sustainable approach to managing money that can improve your quality of life.

On the flip side, being a cheapskate can strain relationships, lead to missed opportunities, and ironically, often results in spending more money in the long run. It can also create unnecessary stress and a constant feeling of deprivation.

Finding the Balance: How to Be Frugal Without Being Cheap

- Focus on Value: Ask yourself, “Is this the best use of my money?” rather than just “Is this the cheapest option?”

- Set Priorities: Decide what’s important to you and be willing to spend money in those areas while cutting back on less important expenses.

- Think Long-Term: Consider the long-term costs and benefits of your purchases, not just the immediate price tag.

- Be Generous: Don’t let your desire to save money prevent you from being generous with others, whether through tipping, gift-giving, or charitable donations.

- Quality Over Quantity: Invest in fewer, higher-quality items rather than lots of cheap ones that won’t last.

- DIY Wisely: Embrace DIY for things you enjoy or are good at, but know when it’s worth paying for expertise.

- Respect Others’ Time and Resources: Don’t let your frugality infringe on others or take advantage of their generosity.

The Bottom Line

Being frugal is about making smart financial decisions that align with your values and long-term goals.

It’s a balanced approach that can lead to financial freedom and peace of mind.

Being a cheapskate, however, is a short-sighted strategy that often backfires, costing more in terms of money, relationships, and overall life satisfaction.

Remember, the goal isn’t to spend as little as possible on everything. It’s to spend wisely on the things that matter most to you while finding creative ways to save on the rest.

So go ahead, be frugal and proud – just leave the cheapskate tendencies at the dollar store where they belong!