If you’re not sure where your money goes each month, a budget can help you figure it out.

Wait! Before the huge sigh of defeat – budgeting doesn’t have to be painful!

It’s just a plan for how you’ll spend and save your money. It helps you avoid overspending and makes sure you have enough for the things that matter most.

You don’t need to be a money expert to build a budget. You just need to know how much you make, what your basic needs cost, and what your goals are.

In this article, we’ll walk you through how to build a monthly budget step by step. You’ll learn how to track your spending, set goals, and adjust your budgeting as life changes.

With a simple plan in place, you can feel more in control of your money—and less stressed about it.

What is a Budget?

A budget is a financial plan that you create every month.

The goal of a budget is to determine where your money will go each month to ensure you stay out of debt and avoid spend more than you earn.

In its simplest form, a budget should be your income minus your spending.

The number left over can be zero. (Also known as a zero-based budget)

Or you can have extra money left over, which can go towards saving.

Creating a budget every month will allow you to adjust your spending if you went over in some areas or have specific events or out-of-the-ordinary expenses that have popped up.

You can set goals with your budget and also find areas to cut your spending.

How to Start a Budget?

Starting a budget is very simple, and you can even start today.

However, your first few attempts will probably be a learning curve. As you spend and evaluate, you may realize that you budgeted too much or too little in specific categories.

To successfully start a budget, you want to have a general idea of how much you spend every month and your Cost of Living number.

Starting a Budget

Step 1 – Track Your Spending

Track your spending for about three months to see your typical spending habits.

You need this info as a base for your budget because it tells you exactly how much you spend on groceries, clothes, dining out, etc.

Step 2 – Calculate Your Cost of Living Number

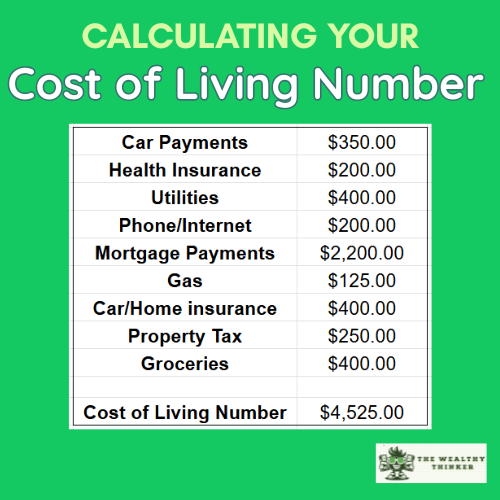

Now that you’ve been tracking your expenses, you can calculate your Cost of Living number, which represents your basic needs in life. This number is the minimum monthly amount you need to be able to pay for your necessities, like your mortgage/rent, food and utilities.

Add this as a line in your new budget since this number should be the same monthly.

Step 3 – Set Up Your Budget

Once you have these two pieces of your spending, you can easily create a budget without the guesswork. Most people struggle because they don’t have a general idea of their spending or how much their basic needs cost a month. Now you do!

In our example above, the Cost of Living number is $4,525.00 per month. So, if your monthly household income is 7,000.00, you have another $2,475.00 to budget for.

Maybe you give yourself a budget line for:

- A clothing allowance

- Savings for your Emergency Fund or investments

- A vacation fund

- Childcare (This would actually fall under Cost of Living if it’s more than a one off)

- A flat ‘Entertainment’ allowance

After all of this, your monthly budget may look something like:

This budget is an example of zero-based budgeting, where you account for every dollar you earn. It serves as you plan for what you intend to do with your money each month, and as you go, you can make adjustments depending on your needs. Maybe you don’t need a clothing allowance every month. Or you don’t have as much debt, or you want to focus more on your health.

HOW you set up your budget is up to you! The most successful budget is the one you stick to, so keep it simple.

Budgeting Adjustments: Fixed vs. Variable Costs

Within your budget, you’re going to have both fixed (You can’t adjust them) or variable expenses (You can adjust them).

The expenses from your Cost of Living number are largely going to be fixed, unless you can re-negotiate your mortgage/rent, utility costs, or make an effort to reduce how much you spend on your groceries, by meal planning, using coupons, bulk buying, etc.

Your variable costs are things that you can control what you spend. So, if you have a tight month, you can forego buying new jeans or not getting takeout that month. You can let your ‘wants’ wait and focus on your ‘needs’.

One budget area that can be challenging for most people is how to handle non-regular expenses that come up. Looking at your budget variables can help you move around funds to cover the unforeseen cost that popped up.

Find out more: What’s Your Cost of Living Number? How to Find it & 3 Reasons It’s Important

How to make your monthly budget?

Making your monthly budget can be a fun and creative outlet for you to do.

There are so many ways to set up and track your budgeting.

You can:

- have a physical journal that you write in

- use a digital planner on your iPad

- create an Excel tracker

- use online tools, like HoneyDue

You can change how you make your budget, but make it something that you’ll enjoy (or at least, not dread), because this is a task you will do every month.

When you sit down to make your budget, use your spending tracker, Cost of Living number, and financial goals to help you plan your budget.

You may have to edit your budget while making it to ensure you have enough money for your basic needs like rent, your spending areas, and any financial savings you would like to have.

You should not be pessimistic about your budget. If you are, adjust your extra spending or savings to ensure you have enough for your basic needs.

How to evaluate your monthly budget?

At the end of the month, it’s essential to evaluate your budget for the month.

This will help you to know if your budget was successful or not.

If it’s not, it’s okay! Fix your allotment for the next month.

There are some common areas where people fail to hit their budget. Some people don’t budget enough for specific spending categories, some people budget too much for some categories, and some people do not plan for particular spending at all.

If you budgeted too little for a category, think about how you want to fix this.

You can either increase that budget line if you have room or decide to cut back in that area. You still want to adjust your budget if you budgeted too much and didn’t spend all of your money in a specific category.

Relocate the extra money you put into a category where you might have spent too much or into savings.

Another area to evaluate in your budget is if you didn’t plan for some spending. Things come up, so you might want a buffer and create an “other” category.

You might not have thought about a spending area when you initially started your budget. If this happens, include that area in your next budget.

Final Thoughts on Budgeting

Budgeting is an essential part of your daily life.

It shouldn’t control your life, but it should give you some structure regarding your spending.

Without a budget, it is easy to spend money and not know where it is going. With a budget, you can plan your spending and make sure you have enough money for all your needs and any saving goals.

A budget doesn’t have to be complex, but it does need to be something you do every month. Evaluating your budget is just as important because it can help you adjust your budget to fit your spending and goals.

Editor’s note: This article was originally published Feb 22, 2024 and has been updated to include better examples and enhance reader experience.