If you ask most people what’s worth stressing about, health, family, and money are the typically expected responses.

Indeed, money is closely connected to health and family, and most things you do every day in one way or another. It’s normal to have financial stress.

Sometimes, however, financial/money stress becomes unhelpful.

Stress is a natural response when something important is threatened. But it can also cause your mental and physical health to badly deteriorate.

Financial stress is often also a source of shame. It’s a form of stress that people can feel far more obliged to hide from their partners or others who could help them.

The fear of judgment itself is problematic. It can set in motion a stress loop where an individual doesn’t seek the mental and financial help they need.

This can lead to:

- Worsening mental health

- Eventually, worsening overall health

- More strenuous financial circumstances

- Debt

- All of the above, causing even more financial stress and shame

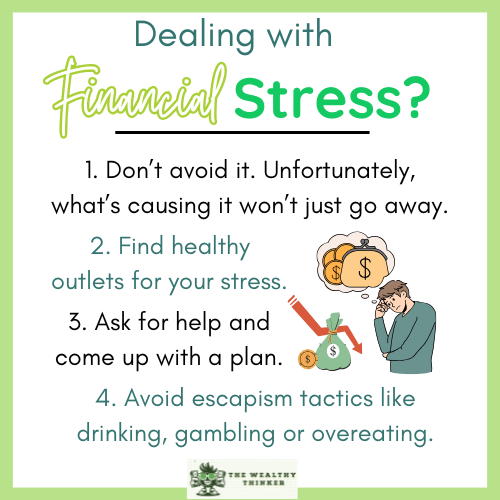

If you’re struggling with financial stress, or even just struggling financially and stress hasn’t kicked in, there are things you can do.

In this article, we will go over:

- The financial depression symptoms

- What to do when feeling financially stressed

- How stress affects your health

- What health organizations recommend you do about financial stress

Financial Depression Symptoms

“Financial” depression symptoms are actually the same as those in other forms of depression. The only major difference is the cause of the depression. The relationship between clinical depression and finance should not be taken lightly, and you should avoid self-diagnosing without seeing a medical doctor.

The British National Health Service (NHI) identifies the following psychological clinical depression symptoms:

- Low mood or sadness over time

- Low self-esteem

- Hopelessness

- Helplessness

- Feeling overwhelmed with guilt

- Irritability towards others

- Lack of motivation

- Lack of interest

- Difficulty making decisions

- Inability to feel enjoyment

- Thoughts of suicide or self-harm

Depression can also manifest itself in physical symptoms. The following physical symptoms may be caused by clinical depression:

- Moving or speaking more slowly than usual

- Sudden changes in weight

- Sudden changes in appetite

- Aches and pains with no apparent cause

- Constipation

- Low energy

- A sudden lowering of sex drive

- Changes to menstrual cycle

- Difficulty sleeping (falling asleep or waking up too early)

Naturally, all of the above symptoms can lead to changes in behavior. Social changes such as less contact with friends and family or neglecting hobbies are common in those with depression.

Your Overall Health and Financial Stress

Financial stress might feel out of your control at times.

You’re not alone if you’re feeling this way. Many people are worried about their financial position. According to a 2023 PWC Financial Wellness survey, 57% said their finances were the top cause of stress in their lives.

However, it’s critical to do everything you can to reclaim control so that financial difficulties don’t turn into other issues. Financial stress can have the following negative consequences if it is not addressed:

- It can have a negative influence on your physical health, sleep issues, increasing your chances of chronic disease, and other issues. Financial stress has also been linked to an increased risk of migraines, according to one study.

- It can have a negative influence on your mental health, substance misuse, anxiety, and increasing your chances of developing depression.

- It can influence your mental well-being, increasing the likelihood of interpersonal issues (such as marital and friendship tensions), work satisfaction and performance, and your general view on life.

What to do when feeling stressed financially?

While financial depression isn’t clinically differentiated from clinical depression overall, its underlying cause (financial stress) is a unique form of stress.

Many of the recommended courses of action are those associated with broader mental wellbeing. But during times of extraordinary financial stress, it’s important to find healthy outlets for your stress.

Both the NHI and Australia’s HealthDirect suggest looking after your physical health during the process.

More specifically, they both recommend regular exercise and healthy dietary habits. Staying active isn’t meant to distract you from your problems, but rather to keep your emotions and mental health in check.

If you’re dealing with financial stress, one of the first and best steps you can take is to develop and stick to a healthy living plan that includes a major concentration on financial health. This plan might assist you in visualizing your future and pursuing health and well-being in all aspects of your life. It’s the road to a healthier, happier self.

Try concentrating on these three key components as part of your wellness plan: get healthy, live healthy, and retire healthy.

Get healthy.

Determine which aspects of your personal life are out of order and give them the care they require:

- Determine what is causing your financial stress, such as loans, tuition, bills, and home expenditures.

- Reduce your expenditures where you can and pay off your debts first.

- Check with your HR department to see if there are any financial wellness services accessible to you and if so, make use of them! Many businesses are recognizing the financial hardship that their employees are under and are now providing these services to them for free.

- Make a cushion of funds.

- Seek out specialists that can assist you in dealing with financial stress, including both financial and mental health specialists.

Live healthy.

Wellness requires dedication to making healthy decisions.

Financial health, like preparing nutritious meals or keeping physically active, is based on making smart decisions, from day-to-day decisions to life’s major milestones.

Here are some suggestions for living a healthy financial lifestyle:

- Create a workable operating budget that accounts for both living expenditures and discretionary expenses.

- Examine your financial obligations for both minor and large expenditures.

- Differentiate your needs from your wants, yet give yourself a treat now and then.

- Align your financial expectations and create goals with your spouse.

Retire healthy.

Wellness is indeed an adventure, and you should envision where you want to go on it.

There are several tools available to assist you in achieving your retirement objectives. You may welcome your old age with a higher feeling of well-being and retire comfortably by taking tiny and persistent measures.

- Build a retirement plan with the help of a financial advisor.

- Create private pensions accounts that suit your needs, such as 401(k) or an IRA.

- Make monthly installments and watch your dreams take shape.

- When important life events occur, like the birth or adoption of children, changing marital status, or becoming a homeowner, you will need to reassess your finances.

- These three areas, when combined, may provide you with peace of mind through life’s challenges, revive your financial confidence, and improve your general well-being.

Try to Avoid Escapism

Escapism is a common response to some sources of financial hardship, especially job loss. For that reason, it’s recommended that you try to hold on to your regular daily routines. Don’t let your routine and sleep habits fall apart as best you can.

It’s also important to not give into escapes like excessive drinking.

Staying on top of your financial challenges with a budget is an inescapable part of financial hardship. Where applicable, you shouldn’t hesitate to reach out to free financial and mental health support resources.

6 Practical Things You Can Do to Cope With a Financial Loss

Conclusions: How does financial stress affect your health?

Financial stress can affect your health in many negative ways. But it’s important to see your stress for what it is: a call to action.

So, DO let your stress motivate you to take a cold, hard look at your finances. But DON’T let your stress go unchecked and allow you to isolate yourself from others and resort to unhelpful coping mechanisms.

Talk to those close to you, as they may be able to help! Even if they can’t help, financial hardship cannot be hidden forever.

Financial stress can lead to mental health challenges including clinical depression, which has a list of negative psychological and physical symptoms.

You may experience any mix of those symptoms, and not everyone experiences or copes with depression in the same way. What’s important is to not beat yourself up and to engage in healthy financial planning and relief measures.

In severe cases of depression, we recommend checking HelpGuide.org. The directory includes relevant resources and hotlines in several countries around the world.

Editor’s note: This article was originally published Dec 4, 2023 and has been updated to improve reader experience.