Keeping your debts low is a fundamental aspect of sound financial management.

But how can you spot the warning signs that your debt is spiraling out of control?

Thankfully, it’s possible to determine how much debt you have before your credit starts to decline or you realize you can’t make your monthly payments.

It’s called the debt-to-income ratio.

Here’s how the debt-to-income ratio functions and why keeping an eye on it – and making adjustments – is a wise move for improved money management.

What is a debt-to-income ratio?

Your debt-to-income ratio, or DTI sounds complicated, but is quite simple: it’s the result of your monthly debt payments divided by your gross monthly income.

That’s it.

Lenders use your DTI as one indicator of your potential to make the monthly payments necessary to return the money you want to borrow.

They also use it to determine how much of your monthly income is allocated to servicing your current debts.

- A low DTI shows that you make more money than you owe

- A high DTI suggests that a larger portion of your paycheck is used to pay off debt

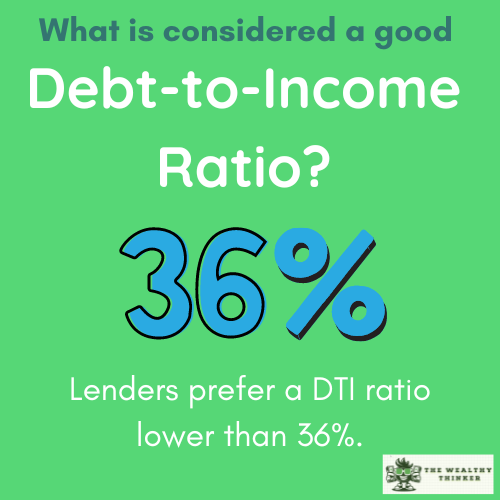

What is a good debt-to-income ratio?

The ideal maximum debt-to-income ratio differs depending on the product and lender.

However, the lower your DTI ratio, the better.

To get approved for a mortgage, for instance, the threshold is often around 36%, while some lenders may authorize up to 43%.

In general, a percentage of 50% or over is thought to be a sign of troubled finances.

So, how do you figure out your percentage?

How to calculate your debt-to-income ratio

Calculating your DTI is easy.

First, you add up all of your monthly loan payments.

This includes:

- mortgage

- credit card debt

- student debt etc.

Then you divide that amount by your gross monthly income. This resulting figure is your debt to income ratio.

The total amount of money you make each month before taxes and other deductions are taken is known as your gross income.

For example, let’s say you pay:

- $1500 for your mortgage

- $100 for your auto loan

- and $400 for the other monthly payments

This would give you a total of $2,000 in monthly debt ($1,500 + $100 + $400 = $2,000)

With a gross monthly income of $6,000, your debt-to-income ratio is 33% (i.e. $2,000 / $6,000.)

What happens if my debt-to-income ratio is too high?

In the event that your ratio exceeds the commonly recognized threshold of 43%, there are a handful of potentially negative effects on your financial situation.

Less flexibility with your budget.

There is less money left over for savings, investments, or spending if a sizable amount of your salary is going towards debt repayment.

Restricted ability to apply for home loans.

If your DTI ratio is more than 43%, you might not be able to obtain a qualified mortgage, which could force you to accept more expensive or restrictive home loans.

Higher interest rates.

When you apply for credit or borrow money, a higher DTI ratio will make you appear like a riskier borrower.

Lenders may impose harsher terms, higher interest rates, and severe penalties for missing or late payments when they grant loans or credit to high-risk consumers.

5 Signs You’re Falling into a Debt Trap & How to Avoid it→

How can I lower my debt-to-income ratio quickly?

Reducing your debt-to-income ratio can affect the way lenders see you when you apply for a mortgage.

You can take a number of actions to lower your DTI, such as:

- Pay your credit cards and any other loans you can in order to lower your overall debt.

- Don’t take on further debt.

- For a simpler and quicker way to pay off debt, think about getting a debt consolidation loan.

- Ask for a raise, take on a second job, or look for a higher-paying primary job to increase your income.

- Examine your spending plan to identify areas where you could make savings to use for debt repayment. Create a budget if you don’t already have one.

Carrying out a monthly calculation of your debt-to-income ratio might also be helpful in determining your level of progress. Seeing it go down will encourage you to continue managing your debt.

Can my debt-to-income ratio affect my credit score?

Not in a specific way.

Your credit score is not determined by the debt-to-income ratio itself.

However, factors that go into your DTI ratio might also have an impact on your credit.

For instance, having large credit card balances may negatively impact your credit score, as well as your debt-to-income ratio. Low balances may also be beneficial to both.

A Debt Management Program: 5 Examples of When You Should Consider One→

Final Thoughts

Your debt-to-income ratio is a vital metric to know if you’re thinking about applying for a loan or other credit.

If your DTI is too high, you may not qualify for the loan you want.

But if you can devise a plan to reduce your debt or increase your income, you can work to reduce your DTI, which may increase your chances of loan approval.

Editor’s note: This article was originally published Oct 6, 2023 and has been updated to improve reader experience.