There are a few systems to pay off debt – and one of the most popular is the Debt Snowball method.

This method helps you get into the habit of paying off your debt and seeing quick success by first paying off your smallest debts.

This allows you to free up some income to tackle those larger debts. It’s a method that has worked for a lot of people.

What is the debt snowball, and how does it work?

The debt snowball is a strategy to pay off your debt.

This is accomplished by paying off your debts from the smallest to largest. Doing this will allow you to gain some momentum to get rid of each loan.

Paying off the smallest debt allows you to build that momentum. For example, it’s easier to tackle a $1,000 loan over a total of $40,000 of debt. When you pay off the $1,000 loan, that minimum payment then rolls into the next smallest debt.

This continues and frees up your income to tackle those larger debts even faster.

How to get started with the debt snowball method?

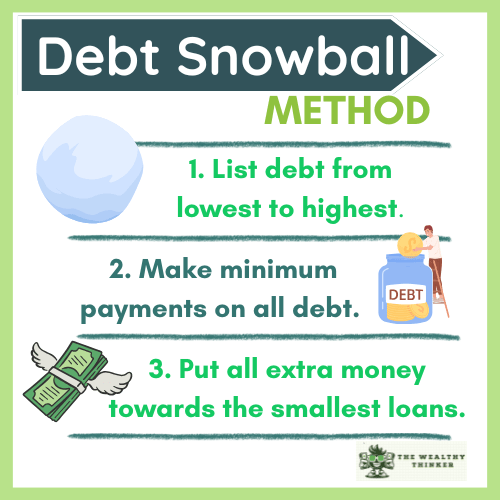

The first step in starting the debt snowball method is to list all of your debts from smallest to largest.

Don’t worry about interest rates. This method does not tackle the loan with the highest rate.

The next step is to continue to make just minimum payments on all debts except for the smallest debt.

You want to continue to have a good status on your other debts and not ignore them. You don’t want to hurt your credit score or have collections calling you.

The next step is to put anything extra onto the smallest debt in addition to the minimum payments.

To do this, you will have to budget.

You need to know your current spending and really look at what you can cut out. Then,

- lower your expenses

- cut spending

- sell unused things in your home

- find a side hustle

All of this extra money will go towards your debt. You’ll keep doing this extra work and reducing your expenses until all of your debt is paid off.

Finally, repeat this process for all of your debts.

After your first smallest debt is paid off, all of your extra savings from reducing spending and side hustles, as well as that previous debt’s minimum payments, will go towards the second debt.

And then when that is done, that money you put toward that debt and the second debt minimum payments will go to the next.

The goal is by the time you are at the largest debt; you are used to extreme saving, side hustling, and paying off debt that you will pay off a huge amount of debt in a record amount of time.

An Example of the Debt Snowball Method

To really understand this method, it’s helpful to see this in action. We will use four debts as an example.

Step 1 – List debt from lowest to highest

- Debt 1 – $1,000 Medical Bill ($100/month payment)

- Debt 2 – $5,000 credit card debt ($120/month payment)

- Debt 3 – $10,000 Car loan ($250/month payment)

- Debt 4 – $20,000 student loans ($200/month payment)

Step 2 – Make minimum payments on all debt

Your total monthly payments will add up to $670/month for your debts.

Step 3 – Put all extra money towards the smallest loans

If you know how much you spend and save a month, you should have a clear idea of how much it will take you to save $1,000.

Let’s say you can save $500 a month towards debt. This means that you will have paid off your first debt in two months!

Your monthly savings are $500 plus $100 (from the monthly payments on Debt 1) for a total of $600/month.

With this knowledge, you know it will take you around eight months to pay off your second debt.

After eight months, you’ll then be able to save $720 a month to tackle your third debt. Then, you will have that third debt paid off in about one year.

Finally, it’s time to tackle your final debt! You will save $880/month towards your final debt. This will take you about two years to finish this loan.

The entire debt snowball took about four years in total to finish paying off all of your loans.

Are You Ready to Try the Debt Snowball Method?

The great thing about this plan is that if you are able to increase your savings, you can pay off your debt faster.

For example, if you are able to save $1,000 a month, you can pay off the first loan in one month.

The second loan in 4.5 months, the third in 8 months, and the fourth in 13 months! Then all of the money you’ve been saving can be used towards reaching your other financial goals.

Editor’s note: This article was originally published Jan 17, 2024 and has been updated to improve reader experience.