Financial literacy for kids: what pops into your head when you read that?

Imagine your child confidently navigating the world of money. Understanding how to save, invest, and make smart financial decisions. This isn’t a dream; it’s a reality you can create by teaching them financial literacy.

In today’s world, financial literacy is no longer a privilege, it’s a necessity.

In this article, we equip you with seven critical basics to share with your children, empowering them to become financially responsible adults.

Let’s unlock their potential and build a strong financial future, together!

Financial Literacy for Kids: 7 Critical Basics to Share With Your Children

1. Invest frequently and early.

Saving money for the future, whether it’s for retirement, a vehicle, or a house, is probably the last thing on a child’s mind.

However, getting started early will help them to profit from compound interest. The “snowball effect” occurs when interest is gained on money that has already been generated as interest.

When children invest early and frequently, they may reap the full advantages in the long term.

What to do first: A parent can create a custodial brokerage account in the child’s name if the youngster is under the age of 18. Some of their money should be invested, while the rest should be kept on the sidelines in case of a market downturn.

Perhaps, try matching a portion of what they invest to motivate them. Index funds are a fantastic choice to start with.

If they have earned money and are under the age of 18, a Custodial Roth IRA is a wonderful option because the growth is tax-free. Plus, they can withdraw their contributions (Not their earnings) for major expenses like a down payment on a house or a car, once they have had a funded account for 5 years’ time.

You could also look at investing in a 529 Education Savings Plan, which will contribute to their future post-secondary expenses. BY choosing an education savings plan option, as long as they are used for qualified education expenses, withdrawals are tax-free.

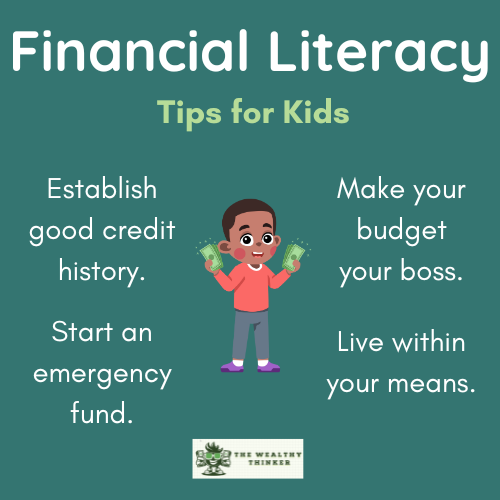

2. Establish an excellent credit history.

One of the best financial literacy for kids tips is that excellent credit begins with borrowing and that taking on a small amount of debt may be beneficial.

However, be wary of credit card issuers’ teaser rates, which may quickly climb into the double digits. We all know about compound interest right? When it comes to saving, it’s fantastic, but when it comes to borrowing, it’s terrible.

What to do first: Your child should get a credit card in his/her name that is connected to their bank account when they reach 18.

Make an automated payment for a modest, recurring payment, such as Netflix or their telephone bill. After that, they should set up an automated payment from their bank account for their credit card bill.

With this strategy, they will never get a late payment fee since they are establishing their credit history.

A secured credit card is the greatest option if your youngster does not match the requirements for an unsecured credit card. This card will have a credit limit of $500, which will be secured against their deposit.

Another bonus is that it can then be used to establish credit before applying for an unsecured card.

3. Make smart borrowing decisions.

There will still be a moment when your children will have to borrow, so educate them on how to do so properly.

They will be able to acquire a lower rate and incur a lesser interest over the term of the loan if they have an excellent credit score.

What to do first: Teach your children the difference between what we call a “bad” debt (such as a vehicle loan or credit cards loan), and a “good” debt – investment into our futures (such as a home or college or mini-business loans).

While your child may need to borrow money for school, it’s not really a good idea for them to purchase a vehicle they can’t afford or max out their credit card.

Before taking out a loan, check around for the best interest rates. Let them know that they should never borrow more money than they can afford in the hopes of getting a salary raise or a new job.

Good Debt vs Bad Debt: The Differences & 6 Ways to Use Debt Wisely→

4. Budgeting is boss.

One of the best tips in financial literacy for kids is stressing the importance of budgeting. Managing their money means determining what their funds are being spent on.

Build-in a habit of keeping track of their expenditures by building a budget. This will enable them to see where they can cut expenses in order to begin saving and investing more money for their future.

What to do first: Build a simple budget system together! You can start with a spreadsheet, or even just a calendar or notebook where they keep track of their goals, expenses and savings.

If you want to go digital, try budgeting apps like Mint or YNAB (You Need a Budget), which combine their accounts and allow them to monitor their expenses and manage their funds.

Of course it’s simple for them to use their credit card to pay for anything, but if they learn they spent $200 on takeout food alone, they may reconsider touching their credit card the next time they have a craving.

Giving your children an allowance for performing their domestic chores might help them develop this habit early on.

Assist them in creating a small budget so that they can learn about money management. Encourage children to save for things like a new bicycle, a new toy, or a new video game.

5. Live within your means.

There are several items on which children spend money without even noticing it. (This tip isn’t just financial literacy for kids, but adults as well!)

Think about it:

- new telephones

- expensive lattes

- fancy clothing

- and so on

While youngsters should be allowed to indulge themselves now and again, be sure their spending does not rule them. They’re living over their financial capabilities if they are unable to pay off their credit card each month.

What to do first: Advise and encourage your youngster to take a step back and consider what is most important to them.

Before making any purchase with their credit card, they should consider whether they truly need such an item. Encourage your children to get a part time job as a method to teach them this lesson.

They will be able to make their own spending errors and learn from them now that they have their own money. They may reward themselves every now and again, if they deserve it and, more importantly, if they can afford it.

6. Understand that investment isn’t the same as gambling.

As a parent, you must let your children know the difference between investing and gambling.

Investing is the act of committing capital to an asset like a stock, with the expectation of generating income or profit. Gambling, on the other hand, is wagering money on an uncertain outcome, that statistically is likely to be negative. A gambler owns nothing, while an investor owns a share of the underlying company. – Investopedia

If you’re out for some fun, using a modest amount of money (let’s say 15% of a small paycheck.) to bet isn’t the end of the world, but you have to be prepared for whatever the outcome turns out to be – and it likely won’t be in your favor.

What to do first: Involve your children in the investment process if you create a custodial account or a Roth IRA for them.

Allow them to pick a few firms in which they want to invest, and you’ll be surprised at how enthusiastic they get. Go through annual statements with them as well so they can see how their investments and savings are doing.

7. Always have emergency money on hand.

Our last financial literacy for kids tip is that you just never know what might happen in the future.

The last few years have really turned the job market on its head and millions of people are looking for jobs. Your children should understand the value of having separate money that can cover 3-6 months of costs of living in the case of any emergency.

They will soon grow up as a young adult with bills to pay, like rent and credit cards. A support system will be provided by having an emergency fund. It’s also critical that children understand the distinction between investments and cash. Encourage them to save some money for day-to-day expenditures as well as major prospective purchases.

What to do first: Taking your children to the bank to create a savings or current account for them is a good idea. Take any cash gifts they get for a holiday or birthday back to the bank and have them save a part of it.

As a result, saving will become a habit rather than a job.

Emergency Fund: Yes, It’s Important & You Need to Start One Right Now→

Financial Literacy for Kids: Teach Them Early!

The significance and relevance of financial literacy for kids and adults can be seen and felt on a daily basis.

And, as parents, one of the most important things we can offer our children is the ability to develop lifelong financial habits.

One of the legacies you’re passing on to your children (and grandchildren!) is a strong financial literacy foundation. As a result, you’ll bring about positive change to your family and the rest of the world.

Photo by Annie Spratt on Unsplash