Retirement doesn’t always mean leaving the workforce abruptly.

An option that many people don’t know about is phased retirement, which enables people to go from full-time employment to full retirement gradually.

In this post, we’ll explore the concept of phased retirement, its benefits and downsides, including how to make it work for you.

What is phased retirement?

Phased retirement is a flexible approach to retirement planning. It lets people who are getting close to the traditional retirement age cut back on their work hours and responsibilities or switch to a job that isn’t as demanding.

The plan is for the worker to go through three stages:

- full-time work

- part-time work while getting half of their retirement income

- and then full retirement

When you are in a phased retirement, you can cut back on your work hours, usually by 20 to 80%, based on what you agree to with your employer. It’s not a one-size-fits-all approach, but can be tailored to suit your specific wants and situation.

How does phased retirement work?

Here’s an example of how phased retirement works.

Let’s say Mary, a 62-year-old employee who has been with the same company for 30 years, is thinking about retiring.

She doesn’t want to leave the workforce right away and is interested in a phased retirement plan her workplace offers. Mary discusses with her company’s human resource department and they agree on a 2-year phased retirement program for her.

In the two years of phased retirement, Mary cut her work hours in half. She works three days a week instead of five. Because she only works part-time, her pay and benefits will be changed to reflect that. She also enjoys some of her retirement perks, like taking money out of her pension or 401(k).

After two years, Mary is now 64 years old and ready to retire for good. She is no longer working part-time, and her employer gives her any retirement benefits or pension that are still due.

In this example, phased retirement allowed Mary to gradually reduce her working hours over 2 years while maintaining a source of income during the transition. This allowed her to make a smoother shift into full retirement.

When can you take a phased retirement?

Each employer has different policies regarding phased retirement.

Programs for phased retirement typically have a minimum age requirement, which is typically 55 or 60. It is usually intended for people who are getting close to traditional retirement age.

Not every business has implemented phased retirement plans. In the event that your employer does not provide this kind of option, you might have to work out a special arrangement with them.

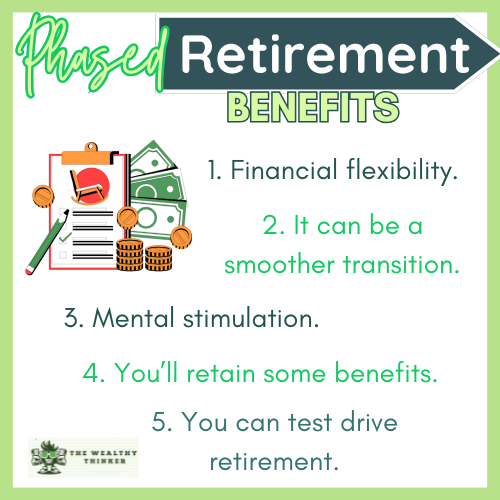

7 Benefits of Phased Retirement

1. Financial flexibility

Choosing to retire gradually can be a wise financial move.

You can boost your retirement income and avoid depleting your savings prematurely by continuing to work part-time.

2. Smooth transition

With phased retirement, the transition to retirement goes more smoothly.

You don’t have to go from full-time work to retirement all at once. Instead, you can slowly get used to a less busy life.

3. Mental stimulation

Many seniors find it useful to keep working or try new things on the side, which is possible with a phased approach.

4. Retaining benefits

Some employers give perks to part-time workers, like health insurance and money put into a retirement plan.

5. Test drive retirement

This is an opportunity to “test drive” what not working will feel like.

You don’t have to fully commit to retirement until you know you’re emotionally, mentally, and financially ready for it.

6. Improved work-life balance

It offers a better work-life balance, which can be good for your health as a whole.

You get to spend more time with your friends and family while still working.

7. Put off Social Security

You can put off getting Social Security benefits if you work longer.

This could mean higher monthly payments in the future.

10 Downsides of Phased Retirement

1. Income reduction

Reducing your work hours results in a decrease in income.

Your finances and retirement savings may be strained if you’re not ready for this transition.

2. Complex financial planning

It might be challenging to manage finances during a phased retirement.

It can be difficult to properly coordinate the combination of a lower income, retirement account withdrawals, and Social Security payments that you may have to deal with.

3. Reduced benefits

Some employers may decide to reduce or eliminate certain benefits as you transition to phased retirement.

This can include health insurance, retirement plan contributions, and other perks you previously enjoyed.

4. Social Security impact

Social Security can be complex, so you may experience a reduction in benefits if you transition to working part-time in a phased retirement.

5. No control over timeframe

Employer policies or employment contracts frequently determine the timeframe for phased retirement.

You might not have full control over how long you can maintain the phased arrangement.

6. Inflexible employers

Some employers may not be willing to work with you to set up a plan, and some may not even offer it.

This may limit your options if your present employer doesn’t support you.

7. Career impact

If you love your job and want to keep working at the same pace, this type of retirement would not be a good fit for you.

Cutting back on your work hours may hurt your career progression and ability to move up the income ladder.

8. Healthcare coverage

If your employer pays for your health insurance, cutting back on hours could affect your ability to get these benefits.

This could force you to look for other healthcare choices, like Medicare, before you’re ready.

9. Social isolation

You may become socially isolated because you spend less time at work, especially if work has been your main way of meeting new people.

10. Stagnant savings

Your funds may stagnate or increase more slowly if you don’t make contributions to your retirement accounts during this phased approach.

The long-term effects of this could include decreased financial security.

Making Phased Retirement Work for You

Make a plan: Plan ahead for your phased retirement, far in advance. Be explicit about your expectations, and have a conversation with your employer about your ambitions.

Test the waters: To ensure that a part-time job fits your demands financially and lifestyle-wise, test it out for a few months before committing entirely.

Assess your financial situation: Establish your financial objectives and evaluate whether taking a part-time job will help you save enough money for retirement.

Consider healthcare costs: Find out how working fewer hours may affect your health insurance and how much it will cost.

Understand the legal and tax implications: To learn about the legal and tax ramifications, speak with a financial advisor or tax expert.

Remain active: This offers an opportunity to continue living an active lifestyle, take up new interests, and be involved in the community in addition to cutting back on work hours.

Final thoughts

With phased retirement, you can enjoy the financial and mental advantages of both work and play while embracing retirement at your own pace.

Take this adaptable strategy into account when you prepare for retirement to make the most of your golden years. Recall that there is no one-size-fits-all approach to retirement, and one of several options for personalizing your retirement path is a phased approach.

Editor’s note: This article was originally published Oct 26, 2023 and has been updated to improve reader experience.