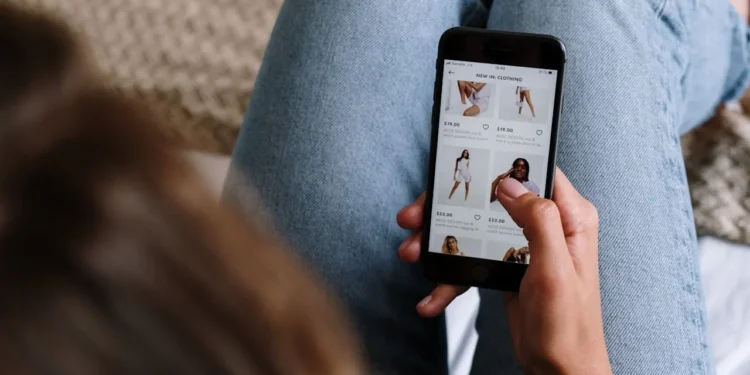

Netflix’s latest documentary, Buy Now! The Shopping Conspiracy, takes a hard look at the hidden mechanisms that drive consumer spending in the digital age.

The film uncovers the sophisticated tactics used by e-commerce giants to manipulate shoppers, turning everyday browsing into a psychological battlefield.

The documentary explores how algorithms, persuasive marketing, and the promise of convenience have transformed shopping into an almost addictive experience.

Beyond the corporate interests at play, it also offers solutions for consumers to reclaim their purchasing power.

Below, we break down three key takeaways from the show that can help shoppers become more informed and financially savvy.

3 Key Takeaways from Netflix’s Buy Now! The Shopping Conspiracy

1. The Dark Side of Algorithm-Driven Shopping

One of the most eye-opening aspects of the documentary is its deep dive into how artificial intelligence and machine learning fuel consumer spending.

E-commerce platforms don’t just recommend products; they:

- track user habits

- monitor browsing patterns

- even analyze emotions to push the right product at the perfect time

These AI-driven algorithms create a hyper-personalized shopping experience, making it difficult for consumers to distinguish between genuine interest and strategic manipulation.

Additionally, the documentary exposes the use of dynamic pricing – a tactic where prices fluctuate based on browsing history, location, and even time of day.

Retailers strategically adjust prices to create urgency and maximize profits, often making shoppers feel pressured to buy now rather than wait for a better deal.

Takeaway: Recognizing these manipulative tactics is the first step in resisting them!

To counteract algorithm-driven shopping, consumers can:

- use price comparison tools

- clear cookies to prevent tracking

- set strict budgets before engaging in online shopping

Taking a moment to pause before making a purchase can also help distinguish between genuine need and artificial urgency.

2. The Psychological Tricks Behind ‘Buy Now’ Culture

The documentary reveals the many ways e-commerce platforms exploit human psychology to drive sales.

Scarcity tactics—such as “Only 2 left in stock!” alerts—create a sense of urgency that compels buyers to act fast.

Similarly, social proof, where shoppers see notifications like “John from New York just purchased this item,” fosters a sense of FOMO (fear of missing out), pushing consumers to make impulsive purchases.

The introduction of buy-now-pay-later (BNPL) services has only amplified this issue.

With the promise of instant gratification and deferred payments, consumers are more likely to spend beyond their means, often without fully considering long-term financial implications.

The film showcases how these financing options, while seemingly convenient, can lead to a cycle of debt for unsuspecting shoppers.

Takeaway: Being aware of these psychological tactics can help consumers make more mindful purchasing decisions.

Strategies like waiting 24 hours before making a purchase, setting personal spending limits, and questioning urgency-based marketing can curb unnecessary spending.

Financial literacy and self-discipline are key to resisting these manipulative strategies.

Consumerism: Spending Rises, Yet We Complain About Having No Money?

3. The Hidden Costs of Fast and Free Shipping

The convenience of free and expedited shipping has drastically changed consumer expectations, but Buy Now! sheds light on the ethical and environmental consequences that come with it.

Behind the scenes, warehouses operate under extreme conditions, with workers subjected to grueling hours and unrealistic productivity demands to meet the growing need for fast deliveries.

Beyond labor concerns, the environmental impact of excessive packaging and expedited shipping is staggering. Every next-day delivery increases carbon emissions and contributes to the growing waste crisis.

Many consumers remain unaware of these hidden costs, as brands prioritize efficiency and profit over sustainability.

Takeaway: Ethical shopping practices can mitigate some of these harms.

Consumers can:

- opt for slower shipping options

- consolidate orders to reduce packaging waste

- support brands that prioritize sustainability and fair labor practices

Small changes in purchasing habits can collectively make a significant difference in reducing the industry’s negative impact.

Final Thoughts

Netflix’s Buy Now! The Shopping Conspiracy serves as both an exposé and a guide for modern consumers navigating the digital shopping landscape.

It’s a reminder that while technology has made shopping easier than ever, it has also given corporations unprecedented influence over consumer behavior.

By understanding the mechanisms at play and adopting smarter shopping habits, individuals can regain control over their finances and make more ethical choices.

Whether you’re a casual shopper or a frequent online buyer, this documentary provides valuable insights into the hidden forces shaping purchasing decisions.

- Have you ever felt the pull of algorithm-driven shopping?

- Have you fallen for one of these tactics?

Share your thoughts in the comments below – we’d love to hear how you navigate the modern shopping landscape!