Impulse buying, or “emotional spending” is a widespread problem.

It’s been a weakness that some people have had since shopping first became a possibility. With online shopping being as easy as ever, making an impulse purchase as a matter of habit is easy.

eCommerce platforms make impulse buying as natural as possible, as browsing stores is a common pastime. In fact, platforms like Shopify try their best to impress upon merchants the power of maximizing impulse purchases.

With statistics like those reported by Shopify itself, it’s quite likely that you or someone you know has a problem with impulse buying. In this article, we will cover:

- What impulse buying is

- The ‘One In One Out’ rule

- How you can use this rule to stop your next impulse purchase in its tracks

- The different types of impulse purchasing

- How impulse buying can become a serious problem

Impulse buying meaning

Have you ever made a purchase without having planned to do so in advance?

If your answer is yes, you’ve made an impulse purchase.

We all need to make purchases on a regular basis. We do so to stay alive, stay healthy, and stay entertained. But spending money in a “healthy” manner implies buying with a plan and keeping a larger budget in mind while you prepare for your spending.

Unfortunately, impulse buying is extremely common.

That’s fine for many people; after all, who wants to stress over every single purchase they make day-to-day?

But there’s a fine line between “treating yourself” and having a serious impulse buying problem (which can sometimes be connected to broader mental health challenges).

Shopify was quoting a report from 2013-2014 that revealed that 87% of all US shoppers make impulse purchases. It also found that 50% of all grocery purchases were made due to impulsiveness.

What is the ‘One In One Out’ rule?

The ‘One In One Out’ rule is a simple idea for ensuring minimal clutter in a person’s home while curbing their impulse buying problems.

The rule is as follows: every time a new item enters your home, a similar item must leave.

This rule is embraced by communities that value budgeting and/or maintaining a minimalist lifestyle.

But it can also be embraced as a challenge by someone who has problems with impulsive spending and/or hoarding.

The rule is simple, ensuring it remains consistently understandable and easy to gauge your success. The intended result is equally simple, ensuring that you never have more than you need in your house.

In the context of impulse spending, the ‘One In One Out’ rule makes you suffer if you have a serious problem.

- Every time you buy something you don’t truly need, you’re forced to discard or sell something else.

- You’re only able to have one item for every individual need or function you require in life.

- Or, with items such as clothes, you ensure your wardrobe only contains what you need.

For example, imagine you have one shirt for every day of the week. If you follow the ‘One In One Out’ rule, you will only ever have seven shirts. If you want a new shirt, that’s fine, but you’re going to have to get rid of another.

So, you’re restricting your buying impulses in a meaningful way.

Practicing this rule takes effort!

You will need to remember a few best practices, such as keeping similar items stored close to each other. For example, all of those seven shirts should be hanging in the same closet.

Also, you’ll need to commit to ‘One In One Out’ on an immediate basis. That means no waiting. The moment you purchase the new item, the old item must be removed.

Again, using the seven shirts example, you will immediately take one old shirt off its hanger and put the new one in that place.

3 Key Takeaways from Netflix’s Buy Now! The Shopping Conspiracy

What are the 4 types of impulse purchasing?

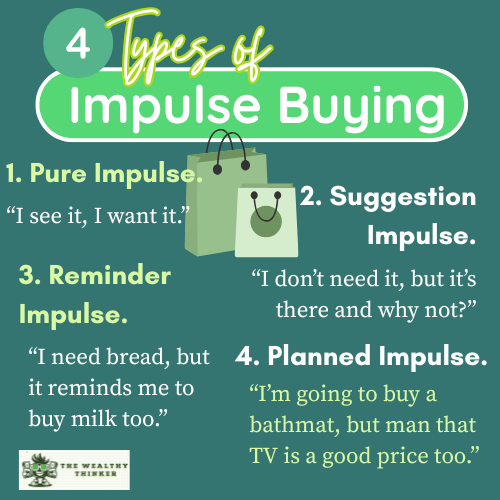

There are 4 subcategories of impulse purchasing. Almost all impulse buying falls under one of these categories.

1. Pure impulse

This is the simplest type of impulse purchase. It’s the “I see, I want, I buy” type.

Like all types of impulse buying, merchants understand this kind of impulse well. That’s why they place certain types of products right by the checkout counter.

They know that those are the items that people are simply more likely to just buy because “why not?”

No rationalization is needed for these purchases. You just make them because you feel like it.

2. Suggestion impulse

These are the impulse purchases that require some level of rationalization.

You have a desire and you want it satiated. However, the lack of a need for the item you’re purchasing makes it an impulse purchase.

Snacks are a good example here. Imagine you’re near the checkout counter, and you feel a bit hungry. You’re going to go home and cook anyway, but you think, “why not, I’m healthy enough and a bag of chips doesn’t take much time or money to buy and eat”.

This level of rationalization leaves customers thinking they are making a decision based on reason, not on impulse. But alas, the store wins, and you’ve made an impulse purchase.

3. Reminder impulse

These impulse purchases are triggered by a reminder.

For example, you were browsing online for a bicycle, but you weren’t planning on buying one. But the way the bicycle offer is presented to you gives you a new feeling that you want to buy it.

After all, you were at least considering buying a bicycle before, right?

4. Planned impulse

While it’s the least impulsive way to impulse purchase, it’s still an impulsive decision.

This kind is one that is triggered by you noticing a very low price tag, for example.

You’re drawn into making a purchase you didn’t plan to before you noticed something like that low price tag. After being affected by the trigger, you plan to make the purchase.

What are the negative effects of impulse buying?

Impulse buying isn’t always the worst thing in the world. But in its extremes, it can worsen some common symptoms associated with depression, while also ruining your finances. Those include:

- Higher levels of anxiety

- Low self-esteem

- Negative moods

- The development of OCD

Final Thoughts: Finding Freedom from Impulse Buying

Impulse buying may seem harmless in the moment, but over time, it can quietly chip away at your financial health and emotional well-being.

By understanding what drives these quick decisions — whether it’s pure emotion, suggestion, reminders, or flashy sales — you can start to take back control.

Simple tools like the ‘One In One Out’ rule can create structure and make you think twice before clicking “add to cart.”

Overcoming impulse spending isn’t about denying yourself joy — it’s about choosing lasting satisfaction over fleeting gratification.

The more aware you become of your habits, the more empowered you are to make mindful decisions that align with your goals.

With a little awareness and consistent practice, you can replace impulse with intention and feel good about every dollar you spend.

Editor’s note: This article was originally published Mar 4, 2024 and has been updated to improve reader experience.