We’ve talked a lot about overspending here, especially in the context of budgeting. But we haven’t really explored why spending too much is such a common issue.

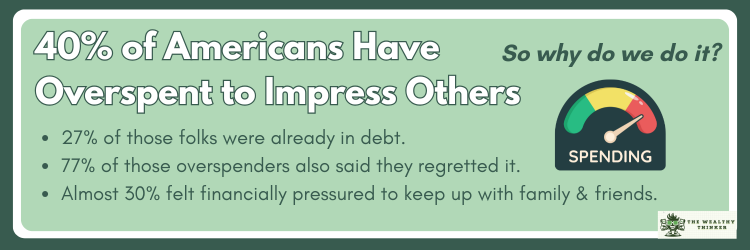

Nearly 40% of Americans surveyed by LendingTree admitted to overspending to impress others, wanting to feel successful, to impact a date or to return generosity.

- 27% of those folks were already in debt.

- 77% of those overspenders also said they regretted it.

- Almost 30% said they feel financially pressured to keep up with family and friends

What leads to overspending and what can someone do to fight it?

A budget is a great start, but if you have a tendency to overspend, setting a budget isn’t a magic pill that cures everything. The psychology of overspending is slightly more complex than that.

In this article, we will go over:

- The main reasons for overspending

- Common examples

- The effects of overspending

- How to stop

What is the reason for overspending?

The reasons for this overlap with different emotions in several ways.

Power and control over your life are common motivators for many behaviors.

To not spend because you can’t afford to spend may create a feeling of powerlessness. If you’re accustomed to having the power to spend and make other decisions, refraining from spending can elicit stronger negative emotions.

Feelings of sadness may be alleviated by spending in some cases.

In these cases, sadness may be a trigger to spend, even when it’s beyond your budget. Sadness is the trigger in this case, and spending is the coping mechanism.

In these ways, the psychology of overspending is similar to many other vices.

- You have a trigger, a negative emotion.

- The way you alleviate that negative emotion is to engage in the negative behavior that leads to overcoming it.

In many cases, people alleviate negative emotional triggers with a “path of least resistance”. This is true of over-eating, some drinking behaviors, and many other simple paths to emotional release.

Like many vices, overspending is a very easy behavior to engage in.

It’s very easy to swipe a credit card or pull some thin papers out of your wallet. But like many other vices, the damage from doing so will come later and may start to snowball if the negative action continues over the long term.

What are examples of overspending?

A classic example of the above psychology would, in fact be overspending.

Imagine you have a lingering feeling of sadness, perhaps even depression.

You are at a mall and see what looks like a great gift for a family member. It’s expensive and you understand on some level that it will worsen your financial problems going forward.

At the same time, you know that your relative will appreciate the gift. It will cause a positive reaction and you will feel happy as a result.

Behind the scenes, your brain is also playing a trick on you. You feel some measure of power and control over your own life. Your ability to purchase the gift, even on credit, even though you can’t really afford it, still provides you with a feeling of control over your situation.

The positive emotions that this provides then overrides the negative consequences of your decision.

In the end, you make the extravagant purchase and engage in massive overspending.

A similar logic to that described above can play out in many different scenarios.

Living with an Overspender: 7 Strategies to Manage Stress & Foster Financial Harmony→

What is the most common form of overspending?

Credit card spending is likely to be the most common contributor to overspending.

When it comes to expenses that are necessary, like home bills, mortgage, food, and others, credit cards are one of the most common payment methods. Credit card debt is also growing, according to the Federal Reserve.

Naturally, it’s difficult to study the question of credit card debt as a part of overspending habits. But credit card debt is a major contributor to overall consumer debt.

When it comes to reasons for overspending, there are a few major ones:

- Peer pressure, such as joining peers in spending

- Boredom, where spending money provides the easiest path to alleviating it

- Compulsive buying, perhaps as a result of crafty advertising or simply seeing something you like

- Special occasions where you lose control and splurge

What are the effects of overspending?

Overspending can lead to a series of highly negative outcomes.

Financial Stress

Financial stress is an issue we’ve covered a lot here. Overspending very often plays some part in creating it.

The symptoms of financial stress are very similar to those of stress caused by other factors. In extreme cases, the symptoms will mirror those caused by clinical depression.

Debt Spirals

This is especially damaging when overspending is supported by credit card transactions (which it very often is).

The consequences of spiraling debt to both your mental health and your finances can be immense. The more debt you rack up, the more damaging and the more difficult it becomes to dig yourself out of the financial hole that it causes.

Austerity

At some point, overspending, especially when it leads to debt, requires a solution. That solution normally requires you to spend far less money.

In these cases, the level of austerity you must introduce into your lifestyle depends on how much debt you’ve piled up. If you’re “overspending” and the result is that you aren’t saving anything, but aren’t going into debt, your case will be less severe.

But if you’re using credit to finance your overspending (no quotation marks here!), you may have to go through a painful period to rebalance your finances.

How do I stop overspending?

Stopping bad habits of any kind is a multi-step process.

Identify Triggers

What triggers your overspending? What are you thinking about when you overspend?

Some common triggers include:

- Feeling sad about something

- Wanting to feel more in control of your life

- Being under the influence of alcohol or drugs

- Feeling peer pressure when you’re around others (not wanting to look cheap or poor)

- Feeling too excited; excitement triggers

Avoid Causes

A good example of this would be leaving credit cards at home, except in cases where you have a specific use for them.

Whenever you identify a trigger, take steps to avoid it or counter it with another action.

Budget

Create a “needs vs wants” budget and set strict rules for both types of spending.

Shop Smart

You don’t need to stop impulse buying entirely!

Instead, you can fit it into your life in smarter ways – even giving yourself a certain amount every month to play with.

Conclusions

Overspending is common. According to many reports, the average American overspends by thousands per year. When asked, almost 40% of Americans admit to overspending to impress others.

Identifying the reasons why you overspend with honesty and self-reflection can set you on the path to reining in your overspending.

Editor’s note: This article was originally published Jun 24, 2024 and has been updated to improve reader experience.