Paying off debt can be a challenging task, but with the right plan and some discipline, being debt free can become a reality.

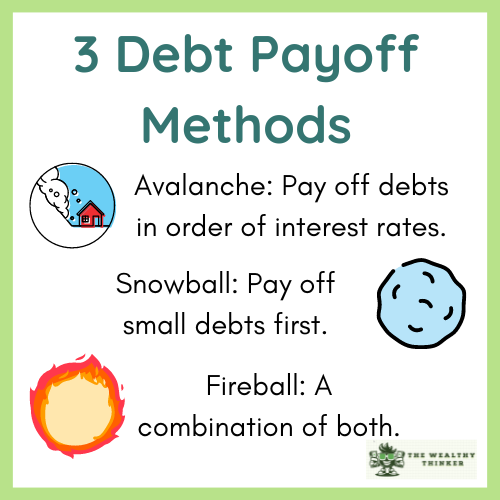

The three main debt payoff methods that have been proven to work are:

- The Avalanche Method

- The Snowball Method

- The Fireball Method

Each of these methods has its advantages and disadvantages, but can also be tailored to suit your own needs.

Have you been struggling to pay off debt? Here are three different debt payoff methods to use to help you succeed.

3 Debt Payoff Methods You May Want to Try

The Avalanche Method – Saves the Most, But Takes the Longest

The Avalanche Method can be one of the most cost-effective.

With the Avalanche Method, you pay off your debts in order of their interest rates.

This means that you’ll start by paying off the debt with the highest interest rate first, then pay off the next debt with the second highest interest rate, and so on.

The idea behind the fist of the debt payoff methods is that you’ll save the most money in interest payments in the long run by paying off the highest interest-rate debts first.

The main advantage of the Avalanche Method is that it can save you the most money by first paying off your highest-interest debt.

However, it can take the longest to pay off your debts for the same reason.

This can be discouraging and may lead to you giving up before you’re able to pay everything off.

This method works best if you have a large sum to put towards your largest debt or if you are good about sticking to something for a long time. However, if you struggle with staying motivated, the Avalanche Method can cause you to give up on any debt payoff plan.

The Snowball Method – Most Motivating, But Best for Smaller Debts

The Snowball Method is the opposite of the Avalanche Method. You pay off your debt in the order of the amount owed from smallest to largest instead of paying off your debts in order of their interest rates.

This means that you’ll start by paying off the debt with the lowest balance first, then pay off the next debt with the second lowest balance, and so on.

The main advantage of the Snowball Method is that it can be more motivating and help you stick to paying off debt the longest. Paying off small debts first can give you a sense of accomplishment and can keep you motivated to continue paying off your debts.

Additionally, since you’ll be paying off small debts first, you may be able to pay them off faster. This can help you pay off your entire debt more quickly because the monthly payments that go towards that smallest loan can be put into paying off your next loan.

The Snowball is one of the most popular debt payoff methods. It is great if you have a lot of small loans under $5,000. This will help you to pay off loans quickly as well as be able to save more for larger loans.

If you like to see instant success, this method is the best because you’ll be able to start paying off your smaller loans much faster than a larger loan.

The Fireball Method – Combines the Best of Both

The Fireball Method is a combination of the Avalanche and Snowball Methods.

With the Fireball Method, you’ll start by paying off the debt with the highest interest rate and make additional payments to the debt with the lowest balance. This allows you to save money on interest payments, while also giving you a sense of accomplishment as you pay off small debts.

The main advantage of the Fireball Method is that it combines the best of both methods.

The disadvantage of this method is that it can be more difficult to keep track of the debts you are working on, since you’re focusing on multiple debts at the same time.

This method is great if you want to test both methods to see what you prefer. Choosing between the Avalanche and Snowball Methods can be difficult, so the Fireball Method allows you to try both.

You may find that you don’t mind seeing slow progress with the Avalanche Method. You may also find you really enjoy the gratifying satisfaction of paying off another small loan and crossing it off your list.

Which of These 3 Debt Payoff Methods Will Work For You?

Paying off debt can be difficult and daunting, but with the right strategy, it is possible to become debt-free.

When deciding on one of these debt payoff methods, it’s important to consider your individual needs and goals. The Avalanche, Snowball, and Fireball Methods are all effective ways to pay off debt, but each has advantages and disadvantages.

Consider your own situation and choose the method that works best for you.