Starting a budget can feel challenging, but the rewards are worth it! Once you get into the habit, having a good financial routine can greatly improve your quality of life – and give you a boost of confidence.

Budgeting doesn’t have to be overwhelming, so why not start with some easy wins?

There are plenty of free budgeting tools that make managing your money simpler, and they vary in features, quality, and cost.

Let’s dive into some of the best free budgeting tools you can try today to kick-start your budgeting journey.

What are the Benefits of Using Budget Tools?

There are several kinds of tools and software solutions for budgeting:

- Complete budget apps

- Budget planners

- Budget trackers

- Tax assistance tools

- Budget calculators

- Financial planning apps

Each of these tools offers simple, easy-to-use features that can help you build better financial habits. They’re helpful for anyone who wants more control over their spending.

For instance, a budget tracker can log your expenses and split them into different categories, like food or entertainment. You can set a limit for each category, and if you go over, you’ll get a notification. This way, you can slowly adjust your spending.

A budget calculator lets you keep track of every purchase to see where your money is going. As you enter each transaction, it automatically adds it to the right category. This way, you can see what percent of your spending is going to each type of expense.

When combined together, budgeting tool features provide:

- Financial clarity

- Visual support in decision-making

- Tech-enhanced goal-setting

- Long-term financial planning

- Customizable or pre-set warnings

Free Budgeting Tools

Most budgeting tools are nominally “free”. This normally means one of three things:

- They are free to use, but you have to watch in-app ads

- They are built on the “freemium” model

- You get a free trial or limited service without payment

We will consider all of these options in the scope of this review, but will add more weight to the tools that offer more without costing you anything.

Read this next: How to Be Richer, Not Poorer: Top 5 Financial Planning Tips For Couples

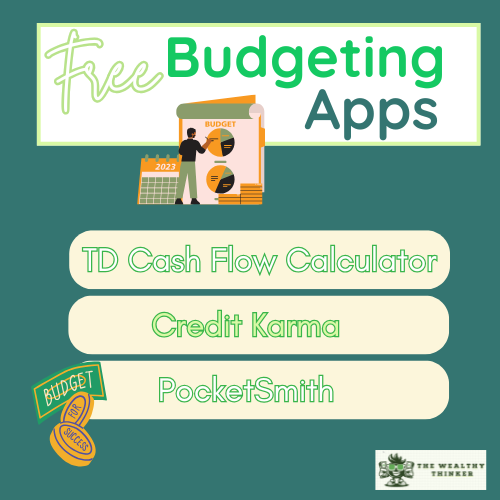

What Are Some Free Budgeting Tools?

One: Painting a Picture (TD Cash Flow Calculator)

This free tool is simply meant to help people answer the question, “where did all that money go”?

While it won’t help you plan your budget going forward, it’s a simple and useful place to start. All you need to do is input how much money you’ve spent on a regular basis.

The focus is on recurring expenses, providing a big picture view of your current financial habits.

Two: Looking & Planning Ahead (PocketSmith)

This budget app is comprehensive, but it falls into the category of “freemium”.

However, you get an exceptional level of support with just their free offer.

PocketSmith is focused on long-term financial planning. It includes all the regular budget tracker and other features. But then it goes one step further with its forecasting abilities and tools.

How PocketSmith works is by collecting your financial information and creating forecasts. It takes the following into account:

- Chequing and savings balances

- Investments of all kinds

- Current holdings/investments

- Loans

This powerful tool can be especially useful if you feel that a lack of motivation is your main barrier to budgeting. The app will be brutally honest with you if your financial information points towards a difficult financial future.

Then, it can even be used for “what-ifs?”, where you can see how things can go differently with a different decision.

The free version of PocketSmith is fairly comprehensive, when compared to other free options. You can use the projections feature for only up to six months ahead, however. But this is a nice free addition to an already comprehensive, yet free offer.

If you do choose to pay for their service, you can get forecasts for up to 30 years ahead. It also enables you to sync PocketSmith with your financial accounts, offering constantly updated information and projections, saving you a lot of time in collecting that information to submit to PocketSmith.

Three: Best Overall Budget Tool (Mint – now Credit Karma)

Mint was an industry leader in the field of budget tools. Many budget tools and reviewers used Mint as the benchmark for comparing other options. In March 2024, Mint moved to Credit Karma, and many of their tools have been moved over as well.

Credit Karma is a complete and free budget tool (You will have to enter some personal information, FYI). It links to all your financial accounts, including chequing, savings, investment accounts, and debts. It then compiles everything into clean, understandable, and useful interfaces.

Because of the syncing option, Mint can constantly give you a complete picture of your finances. It also enables the categorization of spending and budgeting. If you’d like, the app can even create a budget for you based on your financial information.

What’s best is that all these features are free; there are no features they charge you to use.

Free Budgeting Tools – Next Steps

We’ve gone over some of the most popular, well-received, and overall functional budget tools on the market.

However, there may be others that offer niche features that may interest you if you need a budget.

Overall, budget tools take a lot of the guesswork out of establishing a budget and controlling your finances. They provide the organizational framework you need to succeed; the rest is up to you.

Editor’s note: This article was originally published Jan 24, 2022 and has been updated to improve reader experience.

Photo by Mikhail Nilov from Pexels