Let’s be honest – money can be confusing.

If you’ve ever felt overwhelmed trying to understand credit scores, investments, or how much you should be saving, you’re definitely not alone.

Since 2017, The TIAA Institute-GFLEC Personal Finance Index (P-Fin Index for short) annually assesses the financial literacy of American adults. They ask 28 questions, all based around 8 areas of personal finance.

- Borrowing

- Saving

- Consuming

- Earning

- Go-to Info Sources

- Investing

- Insuring

- Comprehending Risk

The 2024 results showed that the US adults who participated answered only 48% of the 28 questions correctly, with 16% of those surveyed considered to have a very low level of financial literacy (Getting 0-7 questions right.).

What does that mean? That less than half of the people who were surveyed are considered financially literate.

All of this points to one thing: financial literacy isn’t just a bonus—it’s essential.

What Is Financial Literacy?

At its core, financial literacy is the knowledge and skills that help you make smart decisions with your money. It covers everything from:

- Budgeting

- Saving

- Investing

- Borrowing

- Paying taxes

- Managing your personal finances day-to-day

It’s not something you learn once and forget. Financial literacy is a lifelong skill, shaped by both education and real-life experience. And the more confident you are with money, the more freedom and security you’ll feel in your everyday life.

Want to see how financially literate you are? Take the quiz on the Global Financial Literacy Excellence Center.

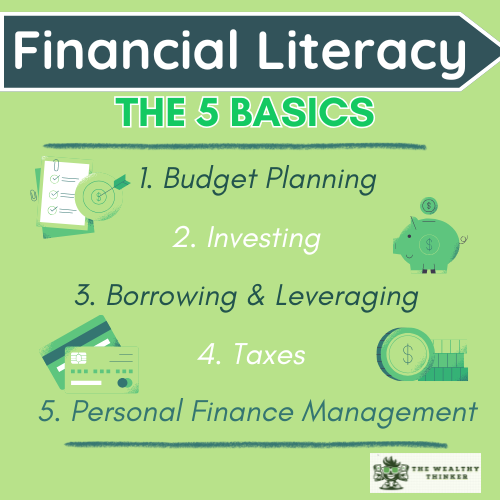

5 Core Areas of Financial Literacy

Let’s break down the five key areas that make up strong financial literacy—and why each one matters.

1. Budget Planning

Think of your budget as your financial blueprint. A good budget helps you balance:

- Everyday expenses

- Saving

- Investing

- Giving

The goal is to stay on top of your bills, eliminate debt, build up savings, and still have room for the things that matter to you. When you manage your money with a clear plan, you’re more likely to make progress and less likely to feel overwhelmed.

What’s the 50/30/20 Budget Ratio? A Simple Way to Set Your Budget

2. Investing

Investing isn’t just for the wealthy—it’s for anyone who wants to grow their money over time.

Understanding key concepts like interest rates, market risks, diversification, and returns helps you make confident decisions and avoid common mistakes.

It’s okay to start small. Learning how to invest—even $50 at a time—can set you up for big rewards later.

Curious About Investing? A Few Things You Should Know Before You Get Started

3. Borrowing & Leveraging

At some point, most of us will borrow money—whether it’s a student loan, a mortgage, or a credit card.

Being financially literate means knowing how loans work, how interest adds up, and how to borrow wisely so you don’t end up in unnecessary debt.

Smart borrowing can be a tool for growth—when used the right way.

7 Important Things You Need to Know About Getting a Mortgage

4. Taxes

Let’s face it: taxes can be complicated. But knowing how taxes impact your paycheck, investments, or side hustle income helps you plan ahead and keep more of what you earn.

Understanding how to read your paycheck, file properly, and take advantage of deductions is a key part of managing your money.

5. Personal Finance Management

This is where everything comes together. Personal finance means managing your whole financial picture: your income, spending, debt, savings, and long-term goals.

When you learn how to juggle all of these areas, you’ll be able to reduce stress, build wealth, and gain confidence in your financial future.

2025 Goals: 9 Personal Finance Books to Help You Boost Your Wealth

Where Can You Learn Financial Literacy?

Good news: you don’t need a finance degree to get smarter with money.

There are tons of resources available to help you build your skills:

- Free online courses (Coursera, edX, Khan Academy)

- Podcasts and YouTube channels focused on money

- Blogs and books on personal finance

- Financial literacy workshops or coaching

- Talking to friends, mentors, or financial advisors

The key is to start with something that feels manageable and stick with it.

10 Respected Financial Literacy Resources to Help You Learn About Money

Final Thoughts: It’s Never Too Late to Learn

Financial literacy isn’t about being perfect.

It’s about giving yourself the tools and confidence to make better decisions—now and in the future.

With more people managing their own retirement and facing complex financial choices, it’s never been more important to understand how money works.

Yes, it takes effort to build financial literacy—but once you do, it pays off in big ways:

✨ Less stress

✨ More control

✨ A stronger, more secure future

So whether you’re just starting out or brushing up on the basics, remember this:

You’ve got what it takes to take control of your financial life.

Editor’s note: This article was originally published Aug 14, 2021 and has been updated to improve reader experience.

Great article with simple language to gain awareness about Financial Literacy.