Thousands of people lose millions to investment scams each year.

Social media has become one of the most popular tools used to commit fraud and criminals are becoming more and more sophisticated with their hacking techniques.

Many people are falling victim to Ponzi schemes and unscrupulous high-yield investments. Thankfully, there are some warning signs, which you can use to avoid falling victim to scammers.

7 Signs of an Investment Scam

If the fund manager cannot explain and show how your money would be put to use if you invest with them, you are better off looking for an alternative.

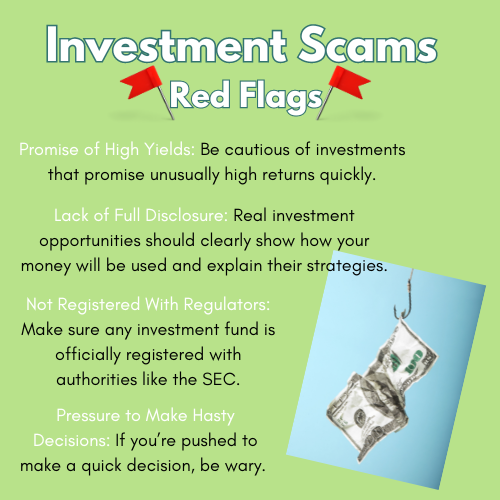

1. The Promise of High Yields

If the returns on the investment are above the average interest rates, then you should be skeptical.

Banks and other financial institutions have a targeted return on investments. These targets are based on the economic conditions and benchmark interest rates set by the Federal Reserve.

If an investor is promising returns higher than what institutional investors or banks give their clients, then you should investigate further. Normally these investments promise high returns within a short space of time.

Getting Social Media Investing Advice: 8 Glaring Red Flags→

2. Lack of Full Disclosure

If the fund operators do not offer full disclosure on how the investor’s funds are being utilized beyond a reasonable doubt, then it may be time to head for the exit door.

Every reputable investor can show how the investor’s money is being channeled. They are ready within a moment’s notice to explain their investment strategies, how much has been invested, and in what ways.

Reports are also published periodically and sent to clients. If the fund manager cannot explain and show how your money would be put to use if you invest with them, you are better off looking for an alternative.

3. Unsolicited Offers

If you get unsolicited calls to invest in a fund, you may want to keep your distance. Though some investment firms may cold call potential clients, persistent and repeated calls from the same company are a red flag.

And this has been one of the more common types of investment scams. Between January 2020 and December 2023, the Pensions Management Institute in London found that:

The institute revealed that boiler room fraud – where victims are cold called by fake stockbrokers and persuaded to invest in worthless, non-existent or near-bankrupt companies – cost £553m over the period, scamming 20,789 people. Meanwhile, 12,323 people were conned by Ponzi or pyramid schemes, losing £499m. 1

4. If the Fund Manager is Too Excited

Judging a book by its cover can lead to misconceptions.

However, sometimes you should take it as a cue on what to expect. Though personal targets should not cloud your perception of a fund manager, you’ll probably feel a lot safer if your fund manager is more prudent than you are.

Character is an important trait investors look for when choosing a fund manager. Someone who fails to exhibit fiscal discipline can not be trusted with other people’s money.

An overly or unusually excited fund manager would not augur well with your sensibilities. You may want to invest the person’s background a little bit further before you invest your money.

5. Not Registered With Regulators

If an investment fund is not registered with regulators, then it is most definitely a fictitious company.

Every fund management company should be registered with the Securities and Exchange Commission. To be registered, there are a series of rigorous steps and stringent requirements which are put in place to ensure fictitious companies are not registered.

If a company is not registered, then it is most likely a shady one.

6. Offer of Commissions

The majority of legal investment plans do not provide referral commissions to investors.

Such incentives are frequently used by investment frauds to get existing clients to refer their friends and acquaintances, allowing them to swiftly expand their investor base. If you receive such an offer, you are almost certainly being duped into participating in a Ponzi scheme.

7. Pressured into Making a Hasty Decision

If you’re being urgently pressured into making a quick decision, you may be falling for a scam.

Reliable fund managers wouldn’t push you into making an investment decision without first understanding the basics of the investment product. Instead, they’d want to identify your goals and objectives, choosing an investment product that aligns with them.

Pressure tactics, ranging from limited offers to timed gifts or rebates, are commonly used in investment scams.

The purpose is to bamboozle you into investing your money without conducting due diligence.

Before you commit your funds, step back and find out if you fully understand what you’re buying into. If in doubt – better to walk away with your wallet intact than to commit to any investment on impulse!

Know what you’re getting into: What is Financial Counseling and 6 Questions to Ask to Avoid Scams

4 Ways to Investigate a Potential Investment Scam

1. Gather more information from the person who contacted you before investing.

You can, for example, inquire about the company’s permission or regulation, as well as who the authority or regulator is, the company’s reference number, and its location.

2. The company’s website is your first stop to obtain information about the company.

Look out for any discrepancies in what is being presented on the website.

Also, check with the local financial regulatory authority that has approved the firm. You can check with the SEC’s directory of registered companies. Even when a company is registered, probe deeper. Check out the profile of the management and their track record.

3. Try to visit their social media handles or LinkedIn pages to obtain or verify information.

Look at past companies they have worked for and if possible, try to contact them to obtain more information. If the fund manager has a good reputation, they should definitely get good referrals from their former employers.

4. If possible, pay a visit to the investment firm’s office just to see how the setting is.

The most effective checks are those which entail regulatory confirmation of investigation into the background of the management team.

5 Scam-Free Ways to Help You Find a Financial Advisor→

Common Types of Investment Scams: Key Takeaway

Operators of investment scams try to profit from our greed.

By promising returns that are too good to be true, they try to tap into our basic instinct. However, with due diligence, you can sift fraudulent investment schemes from legitimate ones.

Just have it in mind that there is no such thing as free money!

When presented with a proposal, try to verify the claims. Look into the background of the fund managers and study their track record including the value of assets under which they have previously managed.

Though a visit to the physical location is recommended, it only scratches the surface of your investigative process. Go a step further (e.g. confirming their status from regulators) to find out if they are duly registered or not.

Sources:

1 The Actuary – Billions lost as nearly 100,000 fall victim to investment scams

Your financial education is highly appreciated and timely. It’s a welcome daily tonics.