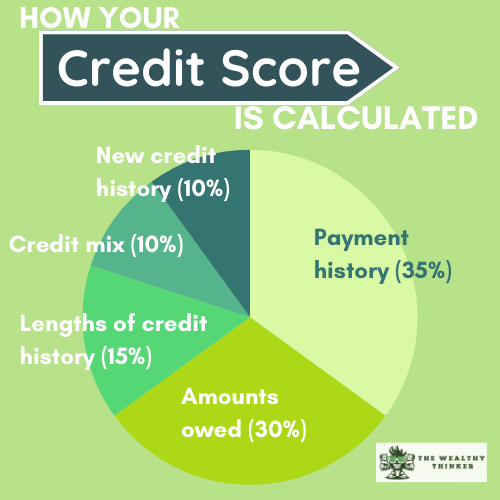

Your credit score is calculated in five categories.

- payment history (35%)

- amounts owed (30%)

- length of credit history (15%)

- credit mix (10%)

- new credit (10%)

Every one of these areas is a way to help you increase your credit score, but it’s essential to understand how they are weighted and which areas will have the most impact.

Within these five categories, there are some you can control and others where that’s not as easy.

Payment history and amounts owed make up a whopping 65% of your credit score.

These two areas have the most impact.

- The length of your credit history is 15% of your score.

- Your credit mix and new credit are both 10%, with a total of 20% of your credit score being impacted by these areas.

The lower percentage areas don’t impact your score as much as the other two high-impact areas, but they can help your score go from great to excellent.

2 Ways to Increase Your Credit Score

1. Payment History

The most significant impact category on your credit score is your payment history.

This packs the biggest punch on your score because it can tell a lender a lot about your credit habits.

Maybe most importantly – how likely you are to pay back your loans.

So, paying your account on time will impact your score the most. If you currently have a 100% on-time payment history, lenders will view you as someone who can pay back their debt on time with no delay.

However, lenders will see you as a bigger risk if you start missing bill payment due dates. Not paying your bills on time impacts your score negatively, and you’ll layer late fees and more interest on top of that.

Once you miss your payments for a certain amount of time, you’ll go into delinquent status and be sent to collections.

To have the greatest impact on your score, pay 99-100% of on-time payments.

If you pay 98% of your debts on time, your score will drop. 98% may seem like a good amount of on-time payments, but in the credit world, it is not. Once you hit 97% or less, you’ll see a lower credit score.

Yep – even missing 3% of your payments will negatively impact your score.

With all this in mind, your payment history is a great place to start if you want to increase your score.

- First, make a list of all of your credit cards and debts that you have.

- Then, if you have a balance on any account, set up automatic payments on these accounts!

This will ensure you’re paying your bills on time and missing zero payments. If you have missed any payments, make sure you get on top of settling those accounts.

2. Accounts owed

Another high-impact area on your credit score is accounts owed, also known as your credit utilization.

This area is a percentage of the total credit limit that you’re using. Every month when a new statement comes in, this percentage will be updated to lenders and can impact your credit score.

To find out yours, find the total credit limit you have on your credit cards and loans.

For example, if you have three credit cards with a maximum credit limit of $7,000 on each card, your total credit limit is $21,000.

To have a good score in this area, you want to only use 0-9% of your overall credit limit.

(That’s $1,890 in this example.)

When you start getting to 30-50% of your credit limit being used ($6,300 – 10,500), this is where you’ll see a decline in your score. Utilizing 75% of your overall credit limit ($15,750) will negatively impact your score.

You may have heard the advice to carry a small balance to keep your score high. This advice is not wrong, but it’s not totally right. Using 0-9% of your credit limit will help to increase your score.

But if you never carry a balance and your utilization percent is 0%, you’ll still be able to have a good score.

However, it’s risky keeping a balance because you will incur interest on any outstanding balance and could forget about it.

To increase your credit score in this area, keep your balances low and don’t use up all of your available credit.

It shows lenders you’re not overextended and will have a higher likelihood of paying your monthly payments.

Final Thoughts on How to Increase Your Credit Score

Understanding how they’re calculated will give you the knowledge on how to increase your credit score.

Credit scores are important because they affect our chances of taking out loans. Making payments on time and keeping a low credit utilization percentage are two ways to increase your score.

Both areas have the largest impact on your credit score, with 65% of your credit score being calculated from these areas.

If you don’t pay your accounts on time or completely miss payments, you’ll have a low credit score. Even missing one payment can impact your score. Start paying your bills on time. If you can, set up automatic payments, so you are never late on paying your debt.

If you have a large amount on your credit cards and max out them, you’ll also experience a lower credit score.

A lower percentage of your overall credit limit will help you increase your score. Start by paying back any large debt you have. Once you’ve reached a low utilization percentage, keep it low. Ideally, don’t carry a balance each month.

Editor’s note: This article was originally published Jul 11, 2022 and has been updated to improve reader experience.