Look, budgeting isn’t exactly the most thrilling topic.

But what if I told you that finding the right budgeting method could be the key to unlocking your financial dreams?

Whether you’re a spreadsheet junkie, a cash-in-envelopes kind of person, or someone who wants their phone to do all the work, there’s a budgeting style out there that’s perfect for you.

Let’s dive into some of the most popular budgeting methods and help you find your financial soulmate!

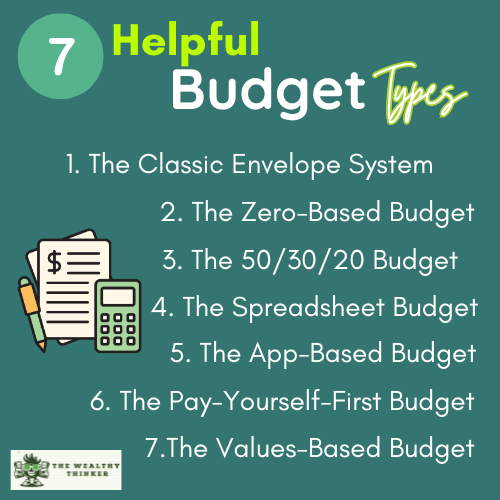

7 Types of Budgets: Which One is Right for You?

1. The Classic Envelope System

Best for: Visual learners and cash spenders

How it works: Divide your cash into envelopes labeled with different spending categories (groceries, entertainment, etc.). When an envelope is empty, that’s it – no more spending in that category!

Pros:

- Highly visual and tangible

- Helps control overspending

- Great for those who struggle with credit card debt

Cons:

- This can be inconvenient in our increasingly cashless world

- Requires regular trips to the ATM

Pro Tip: Try a digital version of this system using apps like Goodbudget if you’re not keen on carrying cash.

2. The Zero-Based Budget

Best for: Detail-oriented planners who like every dollar accounted for

How it works: Assign every single dollar of your income a “job” – whether it’s for bills, savings, or fun money. Your income minus your expenses should equal zero.

Pros:

- Provides a clear picture of where every dollar goes

- Helps identify areas where you might be overspending

Cons:

- Can be time-consuming

- Requires regular adjustments as expenses change

Pro Tip: Use budgeting software like YNAB (You Need A Budget) to make this method easier to manage.

Zero Based Budgeting: How it Works & Possible Advantages

3. The 50/30/20 Budget

Best for: Those who want a simple, flexible approach

How it works: Divide your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment.

Pros:

- Simple and easy to remember

- Provides flexibility within categories

- Good for those with stable incomes

Cons:

- May not work for those in high-cost-of-living areas

- Doesn’t provide detailed tracking

Pro Tip: Adjust the percentages to fit your lifestyle. Maybe it’s 60/20/20 for you!

What’s the 50/30/20 Budget Ratio? A Simple Way to Set Your Budget

4. The Spreadsheet Budget

Best for: Data lovers and Excel/Sheets enthusiasts

How it works: Create a detailed spreadsheet tracking all income and expenses, often broken down into specific categories.

Pros:

- Highly customizable

- Allows for in-depth analysis of spending patterns

- Free if you already have spreadsheet software

Cons:

- Requires regular manual input

- Can be overwhelming for spreadsheet novices

Pro Tip: Start with a template (many are available online for free) and customize it to your needs.

5. The App-Based Budget

Best for: Tech-savvy individuals who want automation

How it works: Use a budgeting app like Credit Karma, Personal Capital, or PocketGuard to automatically track and categorize your spending.

Pros:

- Automatic tracking saves time

- Often provides visual reports and insights

- Can sync with multiple accounts

Cons:

- Requires sharing financial data with third-party apps

- May mis-categorize some transactions

Pro Tip: Take time to review and recategorize transactions regularly for the most accurate picture.

The 8 Best Budgeting Apps to Download Now

6. The Pay-Yourself-First Budget

Best for: Dedicated savers and goal-oriented individuals

How it works: Automatically transfer a set amount to savings as soon as you get paid, then budget the rest for expenses.

Pros:

- Prioritizes saving and investing

- Simple to implement

- Great for building long-term wealth

Cons:

- Requires a good understanding of your necessary expenses

- May not work for those living paycheck-to-paycheck

Pro Tip: Start small if you’re new to this method. Even saving 5% of your income can make a big difference over time!

7.The Values-Based Budget

Best for: Those who want their spending to align with their personal values

How it works: Allocate your money based on what’s most important to you, cutting back on areas that don’t align with your values.

Pros:

- This leads to more fulfilling spending

- Can help reduce impulse purchases

- Aligns financial decisions with personal goals

Cons:

- Requires deep reflection on personal values

- May take time to implement it fully

Pro Tip: Start by listing your top 5 values and see how your current spending aligns with them.

Financial Values: Financial Planning for Your Dream Life – Part 2

Finding Your Perfect Match

Remember, the best budget is the one you’ll actually stick to.

Don’t be afraid to mix and match elements from different types of budgets to create a system that works for you. And if one method doesn’t work out, no worries! Budgeting is a skill, and like any skill, it takes practice.

Start by asking yourself:

- Do I prefer digital or physical tracking?

- How much time am I willing to spend on budgeting?

- What are my biggest financial goals?

- What has frustrated me about budgeting in the past?

Your answers to these questions can guide you toward the budgeting method that’s most likely to succeed for you.

Different Types of Budgets: Final Thoughts

Budgeting doesn’t have to be a chore.

With the right method, it can be an empowering tool that helps you achieve your financial dreams. Whether you’re saving for a tropical vacation, paying off debt, or building your empire, there’s a budgeting style out there that can help you get there.

So, which budgeting personality are you?

- The envelope enthusiast?

- The spreadsheet superstar?

- Or maybe the app aficionado?

Whichever of these types of budgets you choose, remember that the goal is to make your money work for you, not the other way around. Happy budgeting!

Updated from Aug 27, 2024