Expense ratios are just a fancy way of saying “the fee you pay to have professionals manage your investment fund.”

Every year, a small percentage of your money goes toward covering the costs of running the fund—things like paying fund managers, keeping records, and marketing. This fee is automatically deducted from your investment, so you don’t get a separate bill.

A lower expense ratio is generally better because it means you get to keep more of your investment returns. A higher expense ratio eats into your profits over time.

So, when choosing a fund, it’s important to check the expense ratio and understand what you’re paying for.

How to Calculate an Expense Ratio (With an Easy Example)

You don’t really need to calculate an expense ratio yourself, but it’s helpful to understand how it works. Here’s the basic formula:

Expense Ratio = Total Operating Costs ÷ Total Assets Under Management

For example, let’s say a fund manages $100 million in investments and it costs $1 million a year to run the fund. The expense ratio would be:

$1 million ÷ $100 million = 0.01 or 1%

This means if you invest $1,000 in this fund, you’d pay $10 per year in fees.

When researching funds, you might see two types of expense ratios:

- Gross Expense Ratio – The full cost before any discounts or fee waivers.

- Net Expense Ratio – The actual cost after discounts or fee waivers. This is usually the number you should focus on.

Curious About Investing? A Few Things You Should Know Before You Get Started

How Expense Ratios Affect Your Money

Since expense ratios are a percentage of your investment, they’re automatically taken out before you see your returns. If a fund’s expense ratio is 1%, that means for every $1,000 you invest, you pay $10 per year in fees.

The good news? You don’t have to calculate or pay this fee separately—it’s already factored into the net asset value (NAV) of the fund, which is the price of a share in the fund.

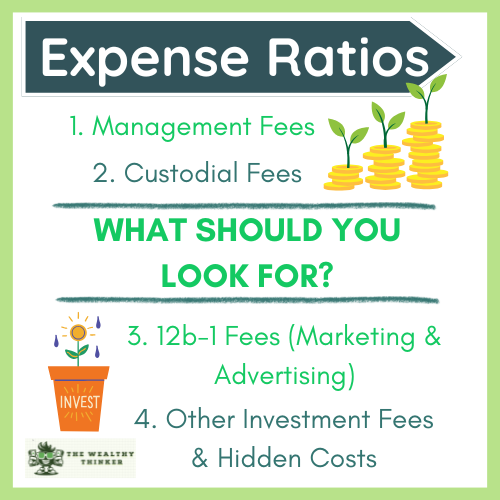

What’s Included in an Expense Ratio?

An expense ratio covers different types of fees, depending on how the fund is managed. Here are the four main costs included:

1. Management Fees

- This is what you pay for the fund’s experts to pick and manage investments.

- Actively managed funds (where managers buy and sell stocks often) have higher fees than passive funds (which just track an index like the S&P 500).

- Example: A high-fee fund may charge 1% or more, while a passively managed index fund might charge as little as 0.03%.

2. Custodial Fees

- Covers the cost of safeguarding your investments.

- Includes things like collecting dividends, maintaining account records, and processing transactions.

- Example: Instead of dealing with tons of paperwork yourself, the fund takes care of it and charges you a tiny percentage.

3. 12b-1 Fees (Marketing & Advertising)

- Some funds charge a 12b-1 fee to cover marketing, advertising, and sales.

- It’s supposed to attract more investors, which might help lower costs in the long run—but this benefit is not guaranteed.

- This fee is included in the expense ratio, but not all funds charge it.

4. Other Investment Fees

- Some funds charge additional costs like sales loads (fees to buy or sell shares), redemption fees (penalties for selling too soon), or trading fees.

- These aren’t included in the expense ratio, so it’s important to check for any hidden costs before investing.

How to Find Expense Ratios for Funds

The good news is you don’t have to do any math—expense ratios are easy to find. The Securities and Exchange Commission (SEC) requires funds to list expense ratios in their prospectus, a document that explains the fund’s details.

You can find expense ratios in:

- Online broker platforms (like Vanguard, Fidelity, or Schwab).

- Mutual fund and ETF research tools.

- The fund’s official website.

Average Expense Ratios: What’s Normal?

Expense ratios depend on the type of fund:

- Index funds & ETFs (passive funds) → 0.10% – 0.30%

- Actively managed mutual funds → 0.50% – 1.50%

According to Morningstar’s 2023 US Fund Fee Study:

In 2023, the average expense ratio paid by fund investors was less than half of what it was two decades ago. Between 2004 and 2023, the asset-weighted average fee fell to 0.36% from 0.87%. Investors have saved billions in fund fees as a result.

What’s a “Good” Expense Ratio?

As a general rule:

- Low-cost index funds: Anything below 0.25% is excellent.

- Actively managed funds: Anything below 1% is reasonable.

- Anything above 1%? You better make sure the fund’s performance is worth the extra cost.

But expense ratios aren’t everything—sometimes, paying a higher fee is worth it if the fund provides strong returns or extra benefits.

Beyond Expense Ratios: Other Things to Consider

Expense ratios are important, but they shouldn’t be the only thing you look at when picking a fund. Some things matter just as much or even more:

- Investment Strategy – Are you looking for a fund that tracks a broad index (S&P 500) or something more specialized?

- Performance History – A cheap fund isn’t helpful if it has terrible returns.

- Fund Type – ETFs, index funds, and mutual funds all have different structures and costs.

- Other Fees – Sales loads, redemption fees, or trading costs can add up, even if the expense ratio is low.

Key Takeaway: Why Expense Ratios Matter

Expense ratios might seem like tiny percentages, but over time, they add up and can have a huge impact on your investments.

Example: The Cost of Fees Over Time

Let’s say you invest $1,000 per year in an ETF with a 6% return and a 0.20% expense ratio for 30 years.

- Total money earned: $80,756.91

- Total fees paid: $3,044.77

That’s $3,000 less in your pocket, just from expense ratios!

Now imagine if you had invested in a fund with a 1% expense ratio instead—it would have cost you $14,040.89 – an extra $10,996.12!

So, while expense ratios aren’t the only thing to consider, keeping them low is a smart way to grow your investments faster.

9 Basic Personal Finance Ratios That Can Change Your Whole Money Mindset

Final Thought

Expense ratios are one piece of the puzzle when choosing where to invest.

Always compare costs, but don’t ignore performance, strategy, and other fees. At the end of the day, your goal is simple: keep more of your money working for you and less going to fund managers.

Editor’s note: This article was originally published Dec 4, 2021 and has been updated to improve reader experience.