Have you ever been told your credit card has been declined, only to find out it is maxed out?

You are not alone. 37% of Americans have maxed out cards.

It’s a horrible, sinking feeling when you get to this point. And your first thought is probably, “What do I do now?”

In this article, we guide you through the consequences of when your credit card is maxed out and the steps you can take to navigate this financial challenge.

What happens if your credit card is maxed out?

Maxing out a credit card means reaching the card’s credit limit, the maximum amount the credit card company has allowed you to borrow.

When this limit is reached, you can’t use the card for additional purchases until you’ve reduced the balance by making payments.

One of the first things that happens when your credit card is maxed out is your credit score can be negatively affected.

Five categories make up your credit score, and one of those categories is credit utilization.

- You want to have a lower credit utilization ratio.

- If you have a credit card that is maxed out, your ratio will be high.

This indicates to lenders that you have borrowed more money against your total credit limits.

Another thing that happens if your credit card is maxed out is the potential for over-limit fees or higher interest rates.

You may not realize your card is maxed out, and if you try to use it, you could be fined a fee for going over your limit. This can make it even more challenging to pay off your balance.

Lastly, there are psychological impacts of having a maxed-out card.

If your credit card is maxed out, you’re probably experiencing stress and anxiety, which can make any financial challenge even harder.

Credit Utilization Ratio: 6 Solid Strategies to Improve Yours

How do I fix my maxed-out credit card?

If you have a maxed-out credit card, there are steps you can take to fix this.

One option is to look into a balance transfer to another card with a lower interest rate.

There are many credit cards that offer no interest for 12-18 months. However, there are usually fees associated with balance transfers. These can range from 3-5%.

Whether you’re able to do a balance transfer or not, it’s important to create and stick to a budget. This will help you make a plan to pay off your credit card and spend within your means.

Another option is to negotiate a lower interest rate or look into debt consolidation.

These options can help you receive a lower interest rate which will reduce how much you owe. This can give you the relief you need to make your payments as well as pay off the balance more aggressively.

Does closing a maxed-out credit card hurt your credit?

Closing out a credit card can be a good thing, but it can also be bad.

If you have a maxed-out credit card and you make a balance transfer or pay off that card, you may want to close the card to remove any temptation or as a way to move on.

Closing a card does not make the debt disappear.

If you choose to close a credit card, this will impact your credit age, one of the five categories that your credit score is made up of. If you’re closing a credit card that’s the oldest, this could bring down your average age of credit.

You want your age to be older. (Think of it like how many years of experience you have – the more, the better.)

Another impact on your credit score when you close out a credit card, is that it reduces your total available credit. This can cause you to have a higher credit utilization ratio if you have a balance on any other credit card as well.

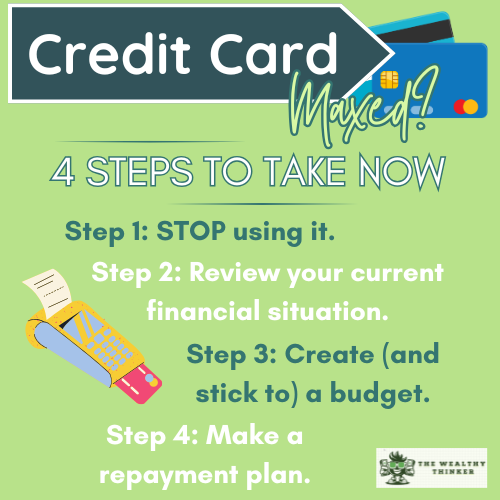

4 Steps to take when you’ve maxed out your credit card

If you’ve maxed out your credit card, there are four crucial steps to take that can help you.

Step 1: STOP

As soon as you know you have a maxed-out credit card, stop using it. This will ensure you’re not fined for anything above your limit.

Step 2: REVIEW

It’s crucial to review your current financial situation. You need to list sources of income, necessary expenses, and costs that can be reduced or eliminated.

Step 3: BUDGET

After your review, you need to create and stick to a budget. Your budget should allow you to make payments on your necessities while setting aside money.

Step 4: REPAYMENT

You’ll need to make a repayment plan to pay off your credit card debts. Focus on paying off the maxed-out card while continuing to make monthly payments on other cards.

Final Thoughts

Dealing with a maxed-out credit card may be a daunting challenge, but it’s important to understand that this financial challenge can be managed and overcome.

The consequences of a maxed-out credit card include:

- Credit score damage

- Higher interest rates

- Over limit feeds

You can work out of this situation by recognizing the problem and creating a budget and repayment plan. Start implementing these steps ASAP to bring you closer to a healthier financial situation.

Editor’s note: This article was originally published Jul 31, 2023 and has been updated to improve reader experience.

Photo by Clay Banks on Unsplash