Consolidating debt is the process of wrapping up all your debts into a single debt.

Say you have multiple debts you’re paying off every month:

- student loans

- credit cards

- medical debt

- high-interest personal debts

Juggling these can be hard to keep track of and probably feels VERY overwhelming to manage. Plus, they may all have differing and challenging levels of interest to pay off.

Debt consolidation is simple: You pay off all these single debts in one shot – by taking on a new loan that wraps all of them in one, giving you a different interest rate and length of time to pay off the total amount.

If you’re struggling with pesky debts and are worried about the consequences, debt consolidation is a viable option.

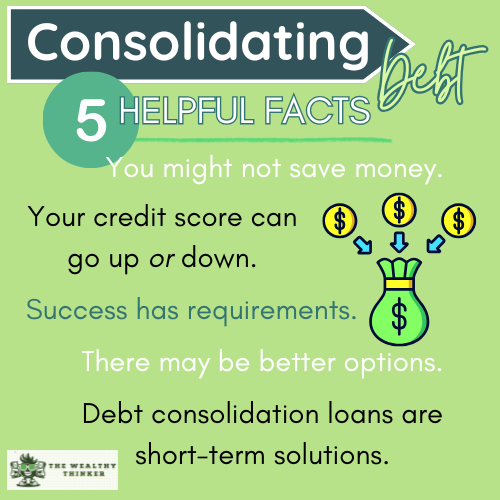

But first, there are a few things you should consider.

One: You Don’t Necessarily Save Money

Debt consolidation will normally save you money.

However, the extent to which debt consolidation can help you will depend on your credit score.

If your credit score is high enough, you should be able to qualify for low-interest debt consolidation loans. This is a much better option to missing credit card payments, which can trigger interest charges of 19.99% or higher in many cases.

When you qualify for better rates than your current credit provides, debt consolidation can save you money. However, this isn’t always the case.

It isn’t unheard of for debt consolidation to cost more than the borrower’s previous debts.

If lenders view you as not being creditworthy, they will place higher demands on you. Debt consolidation loans often require collateral. Read: They need you to add something to the deal in case you don’t pay back the new loan.

If you don’t have good credit and reasonably low debt, you can expect to be asked to provide collateral, such as properties and vehicles.

It’s important to think through your options carefully if you’re in a position where you’re considering debt consolidation.

That means careful consideration of what terms you qualify for.

Want to know more? Read this next: Is Debt Consolidation Right For You?

Two: Your Credit Score Can Go Either Way

Taking a debt consolidation loan has a few effects on your credit score. Some are negative and some are positive.

Applying for debt consolidation requires a hard credit pull. This has a small negative effect on your credit score. Sending multiple formal applications is not recommended for this reason.

Making a lot of formal applications to borrow money will negatively impact your credit score.

In the short term, debt consolidation will have a small negative effect.

Apart from your application, the opening of a new credit account also has a temporarily negative effect. However, this can be reversed if you handle your debt consolidation loan as intended (Don’t miss your payments.).

Debt consolidation offers no guarantees, only your actions do.

Three: Success Has Requirements

Debt consolidation can be your light at the end of the tunnel.

But you still need to travel through the darkness to get to the light.

Like other loans, debt consolidation comes with a repayment schedule. The consequences of your actions regarding debt consolidation are similar to any other loan. If you make timely repayments and handle your loan well, you will reduce your debt and increase your credit score.

On the flip side, the consequences of failing to meet your debt consolidation loan’s repayment terms are:

- Higher expenses from interest

- Negative impact on your credit score

- Potentially more chaos in your personal finances

Four: Debt Consolidation Loans Are Short-Term Solutions

Consolidating debt isn’t a be all end all solution.

They normally aren’t very large loans, and they aren’t meant to last long.

Relative to credit card debt, debt consolidation loans are long-term. This is part of why they are a popular solution to credit card debt. They give you more time to pay off credit card debt, at a much lower rate (assuming you don’t have bad credit).

Debt consolidation loan terms generally range from 2 to 7 years. They are normally on the shorter end of that range.

Given this, debt consolidation loans are a better solution to shorter-term, more expensive debts like credit card debts. However, they aren’t normally good for capturing large debts like mortgages and large auto loan debts.

Five: It’s Not Always Necessary

Debt consolidation can be a great tool, but it’s not the only option.

In fact, there are many other more controllable and less expensive ways to get debt under control.

One potential alternative to debt consolidation is a Home Equity Line of Credit (HELOC).

HELOCs use your home equity as collateral, but so do many debt consolidation loans. However, HELOCs are almost always far more affordable than debt consolidation loans. Also, it’s not hard to justify a HELOC for purposes similar to those for debt consolidation.

If your financial situation is truly extreme, consolidating debt may not even be a viable option. For people who are drowning in debt and also have bad credit, sometimes bankruptcy is the only viable option.

If you’re suffering from a new financial reality you’ve never faced before and are unsure what you should do, try talking to a qualified financial professional. They will discuss your situation and your options with you.

Consolidating Debt vs. Personal Loan

There is some confusion over the definitions of debt consolidation and personal loans.

The reality is quite simple; debt consolidation loans are a type of personal loan.

Personal loans are a broad category that covers many types of loans. The category covers any loan where the arrangement is between a lender and an individual, as opposed to a business, non-profit, or any other organization.

FAQs

What are the disadvantages of debt consolidation?

The main drawback of debt consolidation is that it can easily be quite expensive.

If you can qualify for a better loan, this isn’t a big drawback, of course.

Apart from the normal costs, debt consolidation is only really disadvantageous if you can’t meet the repayment requirements.

Does consolidating debt affect credit score?

Yes, debt consolidation affects your credit score in a few ways:

- Applying will slightly harm your score

- By opening a new credit account, your credit score will temporarily drop

- Depending on how you handle the repayment process, debt consolidation can dramatically raise or drop your credit score

Consolidating Debt: The Bottom Line

Before you decide to apply for a debt consolidation loan, make sure you understand what’s involved.

Also, know that you may have other options, depending on your credit score, how much debt you have to pay off and how much time you have to pay it off.

Editor’s note: This article was originally published Jan 3, 2022 and has been updated to improve reader experience.