Merging finances as a spouse may seem like a good idea. After all, you have a lot of costs in common. It only makes sense, right?

Are you surprised to hear that 20% of people regret merging their bank accounts with their spouse or partner? It’s also common for significant others to have arguments about money at least once a week.

Are there good, practical reasons couples should combine their finances? Yes, sure there are. But that’s in this article: Should Couples Combine Finances? Yes. 5 Good Reasons Why

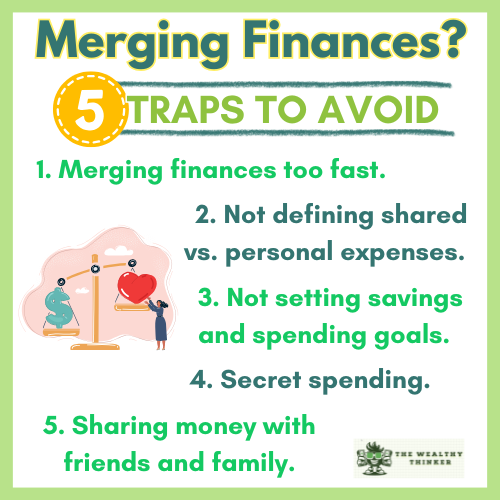

Today we’re looking at seven key areas that can become real pain points when it comes to blending your money with someone else – and we’re going to point them out in hopes you can avoid them.

The 7 Most Common Mistakes to Avoid When Merging Finances With a Partner

1. Putting Your Finances Together Too Soon

If you feel hurried to merge your money right away – don’t do it.

One person may be very young and four years into a secure career with a few thousand dollars in savings, while another may be beginning medical school with a student loan debt of over $150,000. Merging finances here may prove too much of a burden on one of the partners.

So, when do the majority of individuals combine their finances?

According to MagnifyMoney.com, 69% of married couples combine their money, while 16% of engaged couples and 13% of unmarried couples living together do so as well.

One of the first decisions you must make before merging your money is how much to share.

You Combine Your Finances.

This could be a financial budget in which you and your partner each have a joint account for shared spending, while also maintaining separate accounts for personal needs.

This will not only offer you both a strong sense of belonging in terms of financial management of your home and shared expenses, but it will also allow you both some freedom in terms of purchasing personal items.

Consider a fair agreement.

When one individual earns considerably more money than the other, the choice to combine becomes more complicated.

In this case, splitting expenditures 50/50 may appear unfair because one person has considerably more purchasing power than the other.

If you find yourself in this situation, before transferring any cash, it’s a good idea to establish a formal agreement.

We’re not necessarily talking prenuptial agreement here (Although for some, this may be the right option.), but this definitely needs to be at least a conversation, if not an informal agreement or something actually written on paper.

This is a lot more solid than your girlfriend or boyfriend promising to pay the utilities every month, but after a year, you find yourselves sharing the bill for whatever reason.

Prenup? 4 Pros, 4 Cons & 7 Situations Where You Might Consider One

Use the percentage method.

Another method that works for some couples is establishing a percentage each would pay towards bills, based on their income.

For example, the average American monthly household cost of living expenses for the home comes to $6,440. (Head over to this article for a breakdown and visual if you need one.)

The average monthly household income is $7,322 (After taxes).

- Partner #1 brings in 60% of that household income, for about $4,400.00/month

- Partner #2 brings in 40%, for about $2,930.00/month

To use the percentage method, you can divide your cost of living expenses ($6,440) by the same percentage:

- Partner #1 contributes 60% for $3,864.00

- Partner #2 contributes 40% for $2,576.00

This may not work out perfectly in terms of how much each bill works out to, but it gives you a more level playing field.

2. Not Distinguishing Between Shared and Personal Expenses

We cannot underscore the significance of distinguishing between shared and personal costs enough when it comes to sharing finances.

The worst thing that may happen is for your spouse to spend money on something they think both of you are okay with, but you actually don’t want to spend any money on. (Cue argument.)

Consider this excellent and common example: Investing in new bedding. Even if you both use the blanket, your partner may have chosen a less expensive one.

When determining whether a purchase is a shared expenditure, consider the following questions:

- Is this something you both agree on?

- Is it something you both want or need?

If you answer no to either question, the spending will be classified as personal.

3. Failure to Set Savings and Spending Goals

Setting up a joint account without first deciding on savings and spending goals might be disastrous.

Let’s assume you want to save money for a down payment on a house, but your partner wants to go on more trips and have more nights out. You can immediately see the problems that this might bring if not addressed.

Sit down together as a pair and have an honest discussion about your priorities.

You could discover that one of you is a diehard saver, while the other prefers to spend their hard-earned money towards something more enjoyable.

Try to find a happy medium that benefits both parties.

The saver may be content knowing that they reach a monthly savings target, whereas the spender may be content knowing that they have a monthly budget set aside for enjoyable activities.

You need to figure out how to successfully compromise and put your partner’s feelings and ideals first.

6 Shrewd Ways You Can Make Different Money Personalities Work

4. Sharing Money With Family or Friends

When your significant other spends your money on items that are largely for them, you may feel deceived and resentful.

One of the most difficult financial difficulties to address is when one spouse has a family member in financial trouble. It’s normal to want to support someone you care about, but it’s difficult to keep the help going, and the money will not be returned.

Co-managing finances and fulfilling each spouse’s goals, aspirations, and expectations for their extended family may be especially challenging. Consider Patrick and Renee.

- Her mother is arranging a trip to Las Vegas.

- His mother is in dire need of a new automobile.

- Her younger brother is unable to pay his rent.

- His sister’s husband was fired from his job.

So now one spouse is writing a check, while the other is questioning as to why the money wasn’t used to cover household expenses or pay for a family vacation.

When a major crisis happens, such as illness, a major storm, or early death, the pressure might be magnified.

4 Ways You Can Set Clear Financial Boundaries with Friends & Family

5. Secret Expenditures

Keeping secrets from each other can damage your relationship far more quickly than you realize. Losing trust in any situation can be really hurtful, and lead to feelings of betrayal and resentment.

When it comes to money management, the same concept applies. Sharing funds with someone usually points to having a high level of trust, so losing that trust can jeopardize everything.

Massive debt, shopping sprees, addictions (betting, drugs, etc.) are all possible secrets.

Trying to keep these truths hidden instead of discussing them openly and honestly could result in far more irreversible damage.

By being honest and transparent with your partner ahead of time, they may be able to support you in dealing with and overcoming any issues or areas where you might be struggling.

6. Personality Differences

Personality traits can have a huge influence on how individuals talk about money and spend it!

Even if neither partner is in debt, the age-old conflict between savers and spenders can emerge in a variety of ways. Understanding your own and your partner’s financial personalities is essential – and so is discussing these differences openly.

When each partner has a different financial personality, difficulties around money are sure to pop up, causing faults in your relationship.

One partner, for example, maybe a spender – someone who enjoys purchasing new items and isn’t afraid to pay a high price for them. The other is a saver who prefers to look for bargains. If left untreated, this difference might have significant implications.

The best way to handle it is to talk about it openly, as non-judgmentally as possible. Each of you should express your concerns and devise a spending plan that meets both of your needs.

If this is harder than it sounds (And it probably will be! People get defensive around money. It’s normal.) – you might want to spend some time with a financial counselor who can play middleman and provide neutral solutions or tools to help you work together.

7. Different Ways of Assisting Others

The final blunder to avoid on this list is failing to address your reaction when a friend or family member approaches you and asks for money.

If you and your partner have pooled all of your funds and your brother texts you asking for a few hundred dollars, problems can quickly arise.

- Is it your responsibility to tell your brother, no?

- What is your partner’s reaction going to be?

These thoughts will almost certainly cross your mind.

The simplest answer to this problem would be to have some money in your account. You’d have your own money, which you could lend to your brother as you saw appropriate.

Whether or not that is the case, you should talk to your spouse ahead of time to determine if they are okay lending (i.e., donating) money to relatives or friends, and if so, how much, etc.

Final Thoughts on Merging Finances as a Couple

Sharing finances as a couple has several advantages and may save you a significant amount of time and money.

Some of the most serious issues that emerge from merging money can be avoided altogether if you get ahead of them in the first place.

Communicate openly about your financial conditions with each other, and work hard to reach agreements that leave both of you satisfied with your spending.

Editor’s note: This article was originally published Sep 20, 2021 and has been updated to improve reader experience.